While jaw-dropping fundraising amounts attract the big headlines, other firms have found that going public and public offerings continue to offer a legit way to raise cash and provide liquidity, as shown recently by Utah-based Verb Technology, PolarityTE, and LeeWay Services.

AUTHOR'S NOTE:

Although the past two-plus years have produced record-breaking fundraising totals for Utah firms seeking investment monies, the reality is that raising venture capital and private equity dollars are not suitable pathways for every company that needs access to outside capital.

For example, during the last two months three Utah-based firms have instead turned to Wall Street to offer shares for sale in stock market transactions, with two such offerings completed and one in-process, respectively, for

- Verb Technology Company,

- PolarityTE, and

- LeeWay Services.

This report summarizes these public offerings.

Verb Technology Raises $11 Million in a Direct Registered Offering with an Institutional Investor

Lehi, Utah-based Verb Technology (NASDAQ:VERB) announced in late April that it had raised $11 million in gross proceeds by selling 14,666,667 shares and 14,666,667 five-year warrants to purchase shares at 75 cents apiece ($0.75).

The Verb shares and warrants were sold in a direct registered offering to an as-yet unnamed institutional investor.

Formed a decade ago, Verb has developed multiple apps for its clients, most centered around ecommerce.

Case in point, verbLIVE is a live-streaming ecommerce platform used by manufacturers and retailers to promote and sell products by brands ranging from solopreneurs to those generating over $1 billion in annual revenue.

Additionally, during 2021, Verb expanded its marketing and sales efforts to now include clients in life sciences, professional sports, education, the not-for-profit arena, the entertainment industry, and CBD companies.

It should be noted that Since closing its $11 million offerings in April, Verb’s stock price has dropped by one-third to ~$0.50 per share.

During its first quarter, ended March 31, Verb’s gross revenue grew nominally to $2.69 million, up slightly over 6% on a year-over-year basis in 2021 from $2.53 million. However, its digital revenue for the quarter was up over 16% to $2.15 million.

Perhaps more importantly, Verb saw its loss drop to $0.09 per share, down from $0.16/share on a YoY basis.

Looks like an interesting company to keep an eye on.

PolarityTE Raises $8 Million in Direct Registered Offering with an Institutional Investor

Salt Lake City-based PolarityTE (NASDAQ:PTE) announced earlier this month that it had entered into two separate stock purchase agreements with an unnamed healthcare-focused institutional investor that provided approximately $8.0 million in gross investment proceeds to PolarityTE.

In the first agreement, this investor purchased slightly over 1.58 million shares of PTE common stock in a registered direct offering at $2.525/share, for ~$4.0 million.

In the second concurrent agreement, PolarityTE and the institutional investor entered into a PIPE transaction (Private Investment in Public Equity), whereby the investor paid just over $4.0 million to PolarityTE in exchange for ~3.17 million five-year options to purchase PTE common stock at a $2.40/share strike price.

PolarityTE is a 24-year-old biomedical company that, in simplest terms, is currently working on a system where it can grow transplantable human skin in a laboratory that can then safely replace injured or damaged skin, a process and product the company calls SkinTE.

WoundSource describes SkinTE as

“... a human cellular and tissue-based product derived from a patient's own skin to regenerate full-thickness, functionally-polarized skin with all of its layers (epidermis, dermis and hypodermis) and appendages, including hair follicles and glands.”

In this SkinTE approach, PolarityTE clinicians employ an autologous process where

- Healthy skin is removed from one part of a patient’s body,

- Transferred to a laboratory setting where it is grown to a sufficient size, so

- This SkinTE-generated skin product can then be transplanted in a homologous or similar location on the body from where the initial sample was first harvested (i.e., skin harvested from a person’s right leg that is then transplanted onto the left leg).

Two of the most prominent injuries where SkinTE may be applicable include those where it is unlikely that injuries will heal naturally, such as with

- Burn patients, and

- Individuals suffering with diabetic skin ulcers.

In fact, PolarityTE announced in mid-May that it had received a Regenerative Medicine Advanced Therapy (RMAT) designation from the U.S. Food and Drug Administration for SkinTE, which means that the company can pursue further randomized clinical trials for SkinTE.

This new designation from the FDA was apparently granted, in part, because earliest human testing generated over two times greater success in closing serious skin wounds using SkinTE versus traditional methods, a greater than 70% success rate vs. a 34% success rate.

If the company is successful in gaining FDA clearance for SkinTE, and there is no guarantee it will do so, PolarityTE would have a world-changing biomedical product/process on its hands.

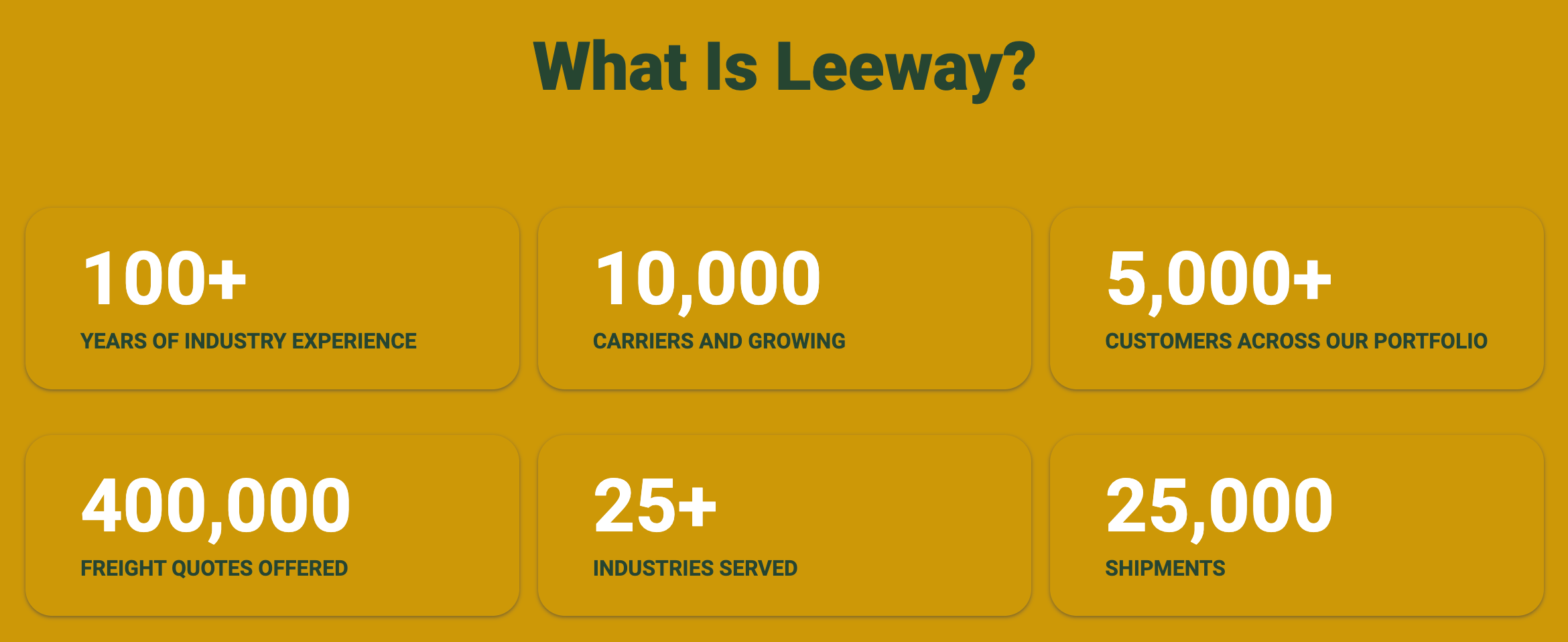

After Reorganizing in December 2021, 30-Something-Year-Old LeeWay Services Decided it’s Ready to Become a Publicly Traded Company by Raising $17 Million

Sometimes it seems like things just kind of happen in life, without an actual plan or a real starting point, something I’ve often observed with family owned and operated businesses.

Case in point, when Salt Lake City-based LeeWay Services filed its Form S-1 with the U.S. Securities and Exchange Commission last Monday, it quite simply stated that the firm was “established (sometime) in the early 1980s,” which I find to be totally priceless, and disarming, at the same time.

To be clear, the S-1 does not, at this time, disclose how much money LeeWay intends to raise via its Initial Public Offering (although several news reports place the targeted total at $17 million).

However, the S-1 is very clear on two primary points.

One, ownership completed a corporate reorganization in December 2021 into what it describes as a “freight brokerage and transportation business” known as LeeWay Services, essentially aligning itself into two subsidiaries:

Secondly, company revenue dramatically increased in the midst of the COVID-19 pandemic, growth that has not appeared to abate during the first quarter of 2022.

Cases in point,

- Revenue in 2021 jumped by 101% in 2021 to nearly $27.9 million, up from ~$13.99 million in 2020, while

- Profits in 2021 rocketed up by over 1,530% to $957,000, an increase from $58,600 in net profits in 2020 and a net loss of $238,000 in 2019.

Additionally, in Q1 of 2022, ended March 31, sales hit $12.3 million with a net profit of $900,000, up from sales of $4.6 million and net profit of $47,000 in the same quarter in 2021.

Digging Into the LeeWay Prospectus

In reviewing LeeWay’s prospectus, it’s clear that the vast, vast majority of company revenue comes from its freight brokerage and transportation business–nearly 98%, in fact.

But its addition of a financial services offering seems pretty clever, if only a modest portion of its revenue today.

If there is anything that I found a bit disconcerting from its prospectus, however, it’s that fact that its top client, McCain Foods USA, represented over 73% of all of LeeWay’s revenue in Q1 2022 at $8.98 million.

The good news/bad news aspect of this is that McCain only represented 47% of LeeWay revenue in the first quarter of 2021. However, in Q1 2021, that total amounted to only $2.18 million.

In other words, McCain’s top line impact on LeeWay’s Q1 2022 results ballooned by over 400% on a Year-over-Year basis.

From a silver lining perspective, McCain Foods USA is part of McCain Foods, a Canadian multinational frozen food corporation said to be the largest provider of french fries on the planet, with close to 40,000 employees globally.

I mention this only because I don’t suspect LeeWay is at risk of getting stiffed by McCain.

Nevertheless, I’m always concerned when any one customer represents more than 15–20% of a company’s income.

Making its Case for Success in the Trucking-as-a-Service (TaaS) Industry

In my continued review of the LeeWay prospectus (along with my own independent digging), however, I felt that the company made some very compelling points to suggest the fractured nature of the trucking industry within the U.S. presented it with some legitimate opportunities..

For example, LeeWay referred to data provided by TruckInfo that suggested there are an estimated 1.2 million trucking companies in the United States. Of these,

- 97% have 20 trucks or fewer, while

- 90% of all U.S. trucking companies, 1,080,000 firms, have six trucks or less.

Additionally, IbisWorld research suggests that the U.S. freight forwarding brokerage industry will reach nearly $196 billion in annual revenue by 2025, clearly a significant marketplace, which IW data says is supported today by 106,000 brokers.

LeeWay also noted in its S-1 that market research firm, Frost & Sullivan, defines the unveiling digitization of the freight forwarding and logistics industry as Trucking-as-a-Service (TaaS).

In fact, in 2019, Frost & Sullivan suggested that the U.S. TaaS market would hit nearly $75 billion in 2025.

And by my prospectus perusal and independent research, it appears that this is clearly the opportunity LeeWay is predominently pursuing.

Will LeeWay be successful in this endeavor? Obviously, I have no idea.

But its recent success suggests it’s certainly a logistics player worth watching here in the state of Silicon Slopes.

It’s apparently also why LeeWay ownership has opted to make its case with the investing public, which I find particularly intriguing given the uncertainty on Wall Street at this time.