A nearly $300 million payday is in the cards for Cricut, a market-leading technology company for DIYers. But many investors will likely be surprised to learn the rest of the IPO story.

Just five weeks after confidentially notifying the U.S. Securities & Exchange Commission of its intent to “Go Public,” South Jordan, Utah-based Cricut is now pitching its shares to Wall Street financial firms on a “roadshow” as it enters the final phase of the process for its Initial Public Offering.

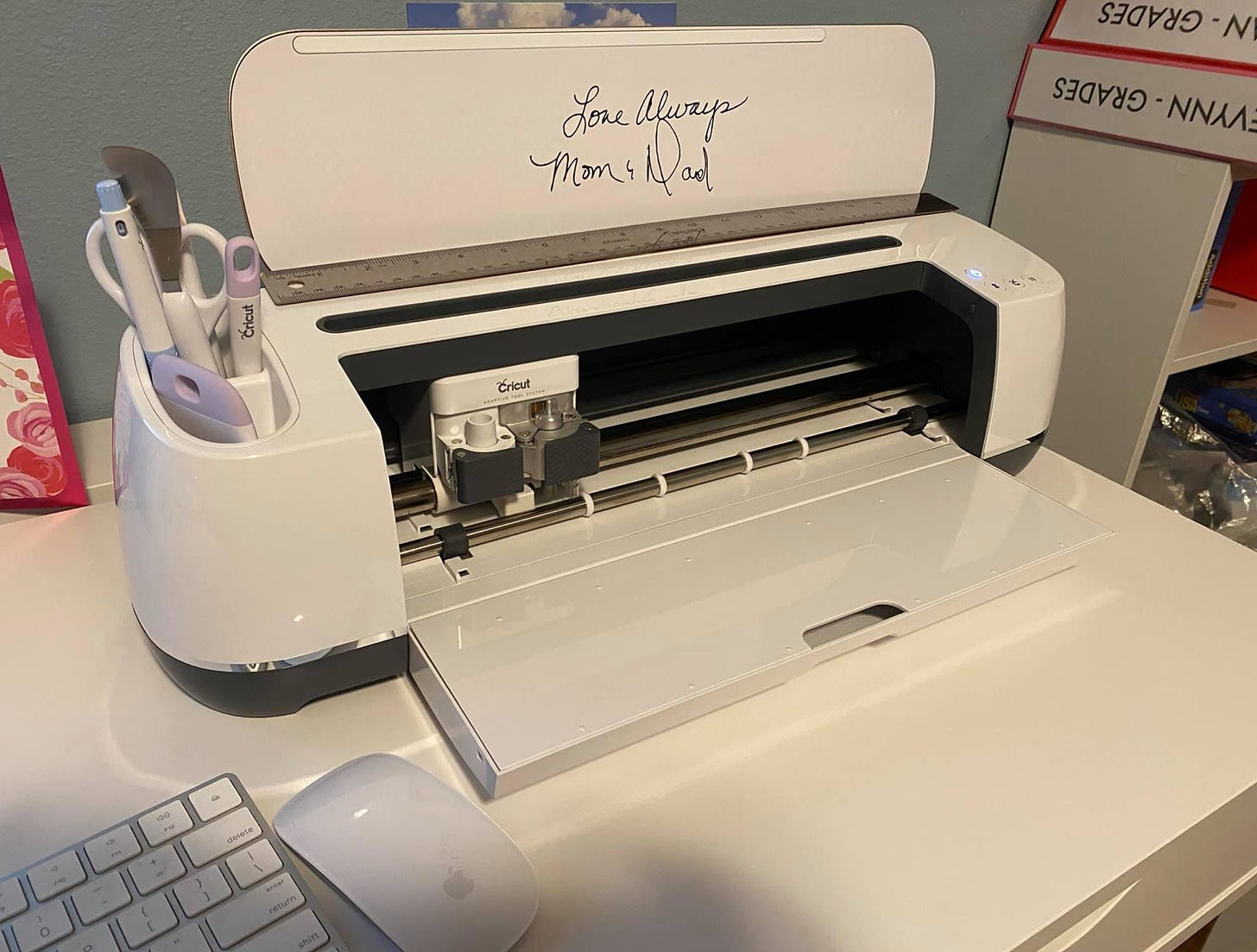

As first reported by Deseret Business Watch on February 16th, Cricut is a nearly 60-year-old company that is quite well-known within the circle of female do-it-yourselfers who love to design, build, publish and create everything, from printed t-shirts to customized coffee mugs to even more elaborate in-home decorations.

But before anyone accuses me of being sexist, the updated and amended Cricut S-1 Registration Statement is VERY CLEAR:

96% of Cricut customers/users are, in fact, women.

To make sure there’s no question about this, I live within a Cricut household, as my wife has owned several Cricut machines over the years. In fact, she owns two different Cricut machines today. And within her circle of creative friends, most also own at least one Cricut machine.

As someone who had creative parents and has been married to a serious Creator for nearly four decades, I am not surprised that Cricut is going public. If anything, I think I’m more surprised that it’s taken them this long to pull the proverbial trigger.

But let’s take a look at some of the Cricut figures.

Digging Into the Cricut Numbers

According to its most recent news release, Cricut plans to sell 13.25 million Class A shares to the public in its IPO at between $20.00 and $22.00 per share. Simple math says that before related costs/fees, Cricut will garner between $265 million and $291.5 million, which is not a bad amount to raise in a straightforward IPO.

{NOTE: By contrast, Provo-based Owlet is going public in a so-called “Blank Check” IPO by merging into a SPAC (Special Purpose Acquisition Company). When all is said and done, Owlet expects to raise over $325 million post-merger.

{Conversely, Draper-based HealthEquity raised just over $400 million in a secondary public offering in mid-February by selling 5 million new shares in its company.}

In addition to the 13.25 million Class A shares Cricut is selling in its IPO as a company, Cricut executives are also selling slightly more than 2 million Class A shares. As is customary, the IPO underwriters have been granted the right to purchase additional Cricut Class A shares at the actual offering price (minus underwriting discounts and commissions), in this case nearly 2.3 million additional Class A shares.

So when it’s all said and done, up to 17.55 million Class A Cricut shares will be available for purchase on the Nasdaq Global Select Market under the stock symbol CRCT.

Except … it’s not all that simple.

The Fun Data from Cricut’s “Red Herring”

As you dig through Cricut’s Prospectus (aka, its Red Herring), there’s really some interesting / promising info there, starting with the fact that 96% of its customers are women (as noted above).

The company also claims to have 4.3 million customers today, with the vast majority living in the United States and Canada), out of what Cricut research suggests is a SAM (Sales Addressable Market) of 85 million prospective clients in North America alone.

Conversely, on a global basis, Cricut believes its potential SAM may be as high as 129 million people.

Historically, Cricut has been in the product business, primarily selling specialty, computerized printers to so-called “Crafters.” To be clear, however, such machines do not just print onto paper.

In fact, as the Prospectus explains, Cricut machines “cut, write, score and create decorative effects using a wide variety of materials including paper, vinyl, leather and more.”

Cricut also has a pretty engaged customer set, with 65% of its customers having used and created something with their Cricut products within the past 90 days.

More than that, however, Cricut’s machines are now Internet-enabled, which allows users to utilize their “Connected-Machines” to access and employ all sorts of digital files from off the Web into their DIY endeavors.

Additionally, Cricut now has two paid subscription service levels that give users access to a curated and growing design library of

- Over 125,000 images,

- 6,000 ready-to-make projects, and

- Hundreds of fonts.

As of the end of 2020, Cricut now has 1.3 million subscribers

Today, Cricut has three revenue streams:

- Connected-Machines (three machines with suggested retail prices ranging from $179.99 to $399.99);

- Subscriptions (as low as $9.99/month or from $95.88/year to $119.88/year); and

- Accessories and Materials.

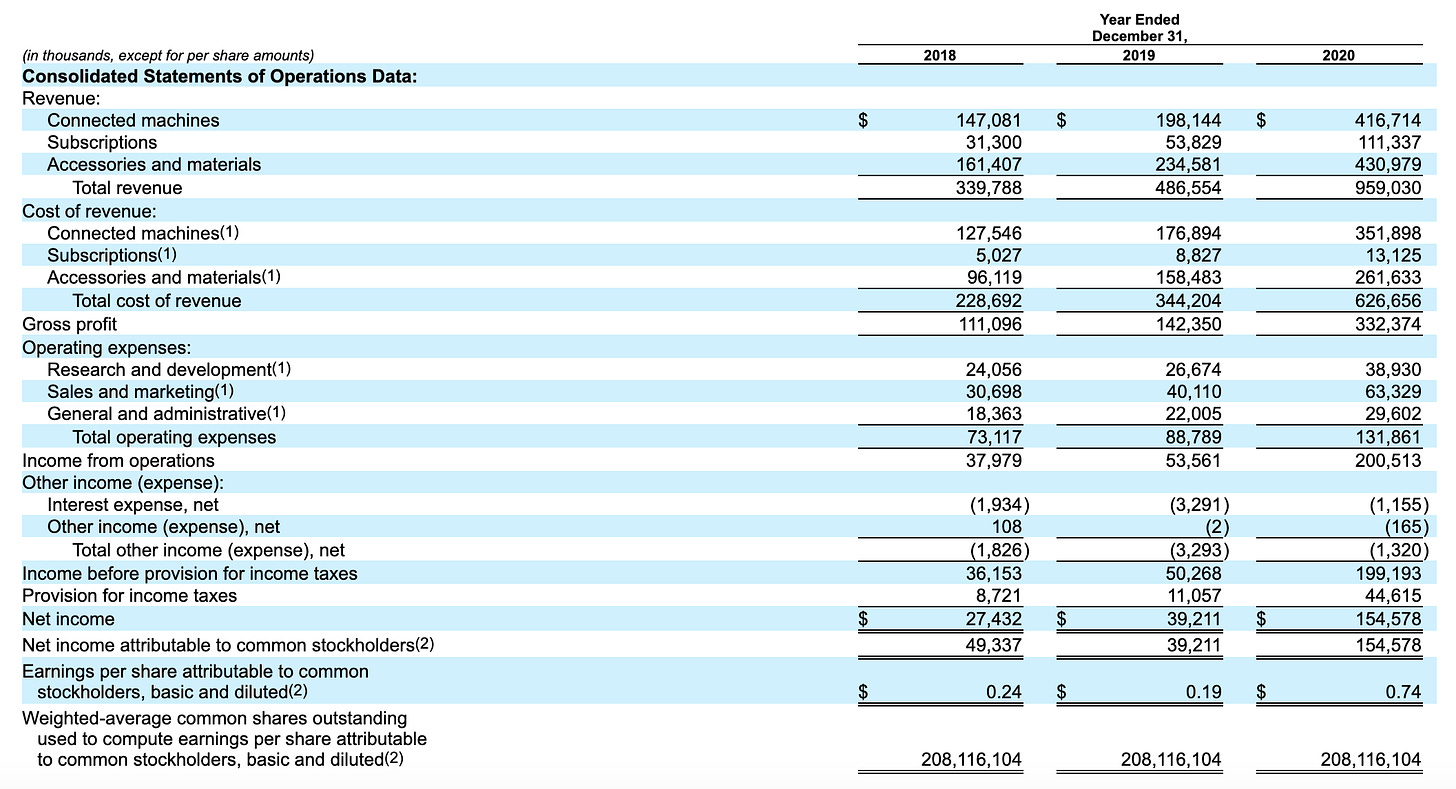

Based upon a review of a Cricut’s Summary Consolidated Financial and Other Data (inserted below), it’s clear that Covid-19 was NOT a negative for the company. If anything, it may have been a boon to Cricut based upon the number of people that had to stay at home during the bulk of 2020.

But here are a few of the numbers that jumped out at me from this summary table.

First, Cricut’s total revenue nearly doubled from 2019 to 2020, from over $486 million up to $959 million last year.

More importantly, the profitability on those sales soared to just over $200 million in 2020, up almost fourfold in 2019 from $54 million.

Revenue in 2020 (and the costs of said revenue) is also telling, especially on a market segment basis. Specifically

- Connected-Machines (Revenue = $417MM; Revenue Costs = $352MM);

- Subscriptions (Revenue = $111MM; Revenue Costs = $13MM); and

- Accessories and Materials. (Revenue = $431MM; Revenue Costs = $261MM).

In other words, on a percentage basis, the Subscriptions generate the greatest amount of gross profit, followed by Accessories and Materials, with the Connected-Machines coming in last place.

However, don’t be confused:

Without its Connected-Machines, Cricut isn’t a market leader in the DIY / Creator marketplace at all.

Will Cricut be able to continue its rapid growth in 2021 and beyond? That’s a key question for the investing public, and is, in fact, one of the topics raised in the Risks section of its Prospectus.

However, there’s another matter that bears exploring that I suspect most people did not know about Cricut until this latest S-1 was filed. And that has to do with who owns Cricut today.

Cricut: A “New” Private Equity Owner, Two Classes of Stock, and a “Controlled Company”

As reported in the February 16th issue of Deseret Business Watch titled “Cricut Plans IPO, Free eCommerce Data, and more,” Cricut sold significant ownership positions in itself to two Private Equity Groups in the early 2000s.

First, Lehi-based Sorenson Capital acquired controlling interest in Cricut in 2005. Financial terms were not disclosed, either then or since.

However, some five years later, Sorenson sold off the bulk of its stake in Cricut to BAML Capital Partners (the then private equity arm of Bank of America).

But BAML was itself then spun-off as a separate PE firm less than a year later to become Ridgemont Equity Partners which is headquartered in Charlotte, North Carolina (with a satellite office in Dallas, Texas).

But here’s where it gets interesting.

The Cricut Prospectus only mentions one outside owner, a firm named Petrus Trust Company, LTA, and nowhere does it mention either Ridgemont or Sorenson.

When I reached out yesterday to Fraser Bullock, a Co-Founding Managing Partner of Sorenson Capital, he explained that Sorenson has “No ownership anymore (in Cricut).”

However, I could find no public record or report disclosing a sale of controlling interest in Cricut to anyone, let alone Petrus Trust Company, LTA.

In fact, Petrus Trust Company, LTA is nearly invisible on the Internet:

- No Website,

- No social media account,

- Nada.

Except the data is there, at least some of it. And after a significant amount of research I was able to uncover that Petrus (in its various forms) is based in Plano, Texas (just down the road from the Ridgemont satellite office).

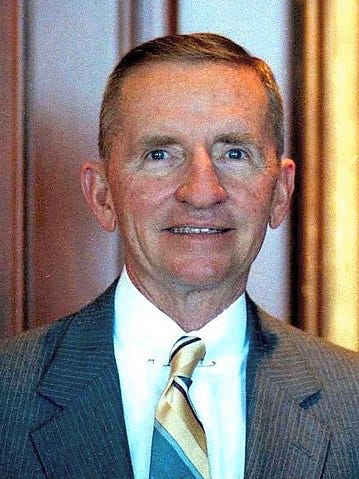

And apparently Petrus is owned by Perot Investments, the family investment office started over 30 years ago by billionaire and former candidate for U.S. President, Ross Perot, Sr.

Based upon its end of the year filings with the SEC (Dec. 31, 2020), Petrus had ownership positions of over 5% in 76 different publicly traded stocks and securities, with a combined value in these securities of more than $1 billion. To be clear, this billion-dollar valuation of AUM (Assets Under Management) does NOT include its ownership positions in privately held companies, like Cricut, or the Petrus cash position.

Because of its near “ghost status” on the Web, there is no way to tell when Petrus acquired controlling interest in Cricut from Ridgemont. Or how much it paid at the time to do so.

What is clear, however, is that after the Cricut IPO, Petrus will control 61.4% of the voting power behind Cricut stock, something that is defined in financial circles as a “Controlled Company.”

In other words, Petrus ownership/management is ultimately the final arbiter on what will or won’t happen with Cricut on a go-forward basis.

That said, however, this is the position Cricut has been for at least the past decade. And going public doesn’t change that, at least not today.

Final Thoughts

Post-IPO, there will be a total of 221 million shares outstanding in Cricut:

- 15.3 million Class A shares, and

- 206 million Class B shares (convertible on a 1-to-1 basis to Class A shares), with

- Class A shares having 1 vote each, and

- Class B shares having 5 votes each.

On a back-of-the-napkin basis, this will give Cricut a post-IPO valuation of between $4.4 billion to $4.9 billion, which is pretty decent.

However, this dual-class ownership of Cricut is a bit disconcerting to me, especially with Petrus controlling over 61% of share voting rights post-IPO.

Will that be a problem for the stock-buying public?

For the answer to this question, we will have to wait and see.

NOTE: This article was originally published by Deseret Business Watch. A few minor editorial changes have been made with this version to better match the current Silicon Slopes writing style.