Salt Lake City-based Black Rifle Coffee Company has announced that it is merging into publicly traded SilverBox Engaged Merger Corp I (NasdaqCM:SBEA).

Post-merger, the expectation is that the coffee-making/selling Black Rifle will be worth $1.7 billion as a publicly traded firm.

Here's the rundown on how a Utah-based coffee company has not only survived in a state dominated by a coffee-teetotaling religion, but has actually thrived and appears primed for the big time of multi-billion-dollar status.

From Northern Idaho to Green Beret to CIA Operative to Coffee-Roasting Entrepreneur

The Master Roaster behind Black Rifle Coffee Company is Evan Hafer.

A self-described lousy high school student, Hafer grew up in the northern Idaho towns of Weippe and Lewiston as part of a multi-generational family of military men and loggers. That background led Hafer to join the Washington National Guard directly out of Lewiston High School in 1995.

It was through his National Guard service that Hafer says he began to discover himself, as he was "reborn."

This re-birth took him first to the University of Idaho, where Hafer joined the ROTC, which put him on a path to join the U.S. Army in 1999 and become a Special Forces Operator as a Green Beret in 2000.

All told, Hafer put in close to 20 years of government service, including his time with the National Guard, as active military, and as an intelligence service employee/contractor.

Speaking of which, after leaving the U.S. Army, Hafer began a nine-year engagement with the Central Intelligence Agency in 2005, with seven of those years serving in combat zones.

So what does any of this have to do with coffee?

In his LinkedIn profile, Hafer writes that

"I fell in love with coffee in Seattle in 1997 and I started roasting coffee in 2006 to take with me on my deployments to Iraq and Afghanistan."

According to Hafer, he even retrofitted his unit's gun trucks so he could grind coffee, put the coffee through a French press, and drink small batch roasted coffee in country.

According to this interview with The Vets Project, Hafer explains

"I was deployed for a decade about 300 days a year to Iraq, Afghanistan, Israel, or Africa."

So, where he could on deployments, Hafer continued to experiment with (and enjoy) his own self-roasted coffee.

"Great coffee (especially on deployments) was one of those things where, if you started your day with it, it just made your day that much better ... whether I was in Mosul or wherever I was."

Fast forward then to Hafer's life post-government service, and what started as sharing and selling his own, home-roasted blends for family and friends began to sprout into something more.

Eventually Hafer realized he "... had to transition completely away from recreational roaster to 'This is my day job.'"

By then Hafer and his family had moved to Salt Lake City, in part to be close to the outdoors and recreational activities available in Utah. So when they decided he would go full time into the coffee business, the capitol city of the State of Deseret was where Black Rifle Coffee Company was born in late 2014.

From Solopreneur to Emerging Multi-Billion-Dollar Enterprise

Today, nearly some seven years on, Hafer now leads a team of over 600 employees, with the headquarters (and main roasting facility) in SLC, and a separate roasting operation in Tennessee.

The focus of the company, Haefer explains, is "... to provide a high-quality product while giving back to the veteran, military, and first responder communities. What I wanted to do was hire high-quality veterans and tell inspiring stories about veterans and giving back to great charitable donations while providing a high-quality coffee."

Of its 600+ Black Rifle employees, the company says that ~50% are military veterans or spouses of veterans. Crazy enough, the company has set it sights on hiring 10,000 military veterans.

Black Rifle currently has three categories of products it sells, including

Various Black Rifle coffee/beverage products, such as

- Twelve-ounce and 5-pound coffee bags,

- Single-serve coffee rounds,

- Ready-to-Drink (RTD) coffee as canned beverages,

- Coffee cold brew packs, steep bags, and instant coffee, as well as

- Two cocoa products; plus

Black Rifle apparel (from shirts to hats to hoodies and more); plus

Black Rifle gear (from mugs to thermoses to coffee-making equipment and more).

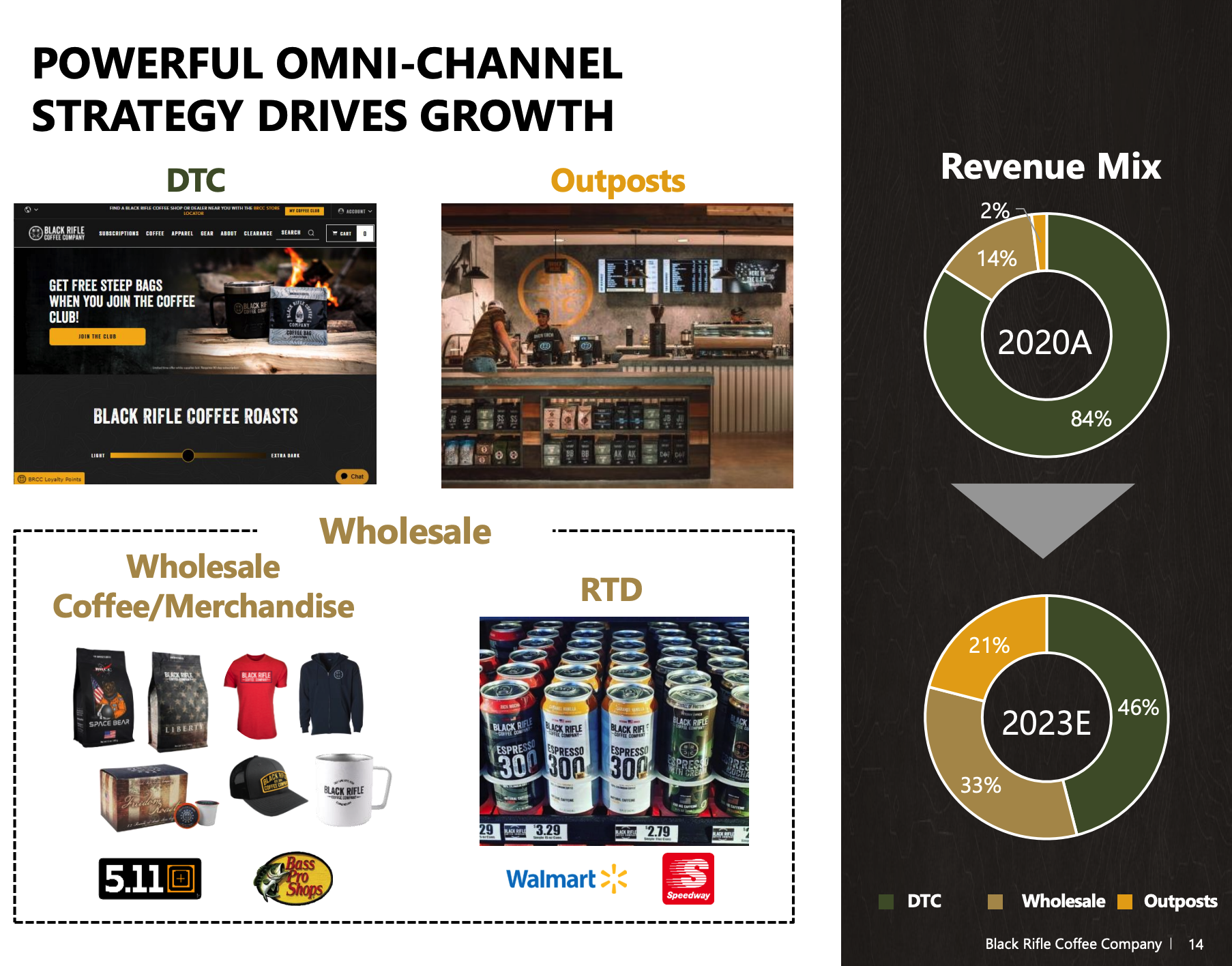

Currently, Black Rifle's primary sales channel is Direct-to-Consumer via online Coffee Club subscriptions or one-off purchases, with over 270,000 subscriptions in place today.

In addition, however, Black Rifle RTD products are also sold in more than 33,000 retail locations across the U.S. today, making it a Top 4 brand in the $4 billion category, with less than 20% penetration in convenience stores.

Black Rifle has also begun opening its own retail stores called Outposts, with 16 total locations expected to be operational by the end of this year.

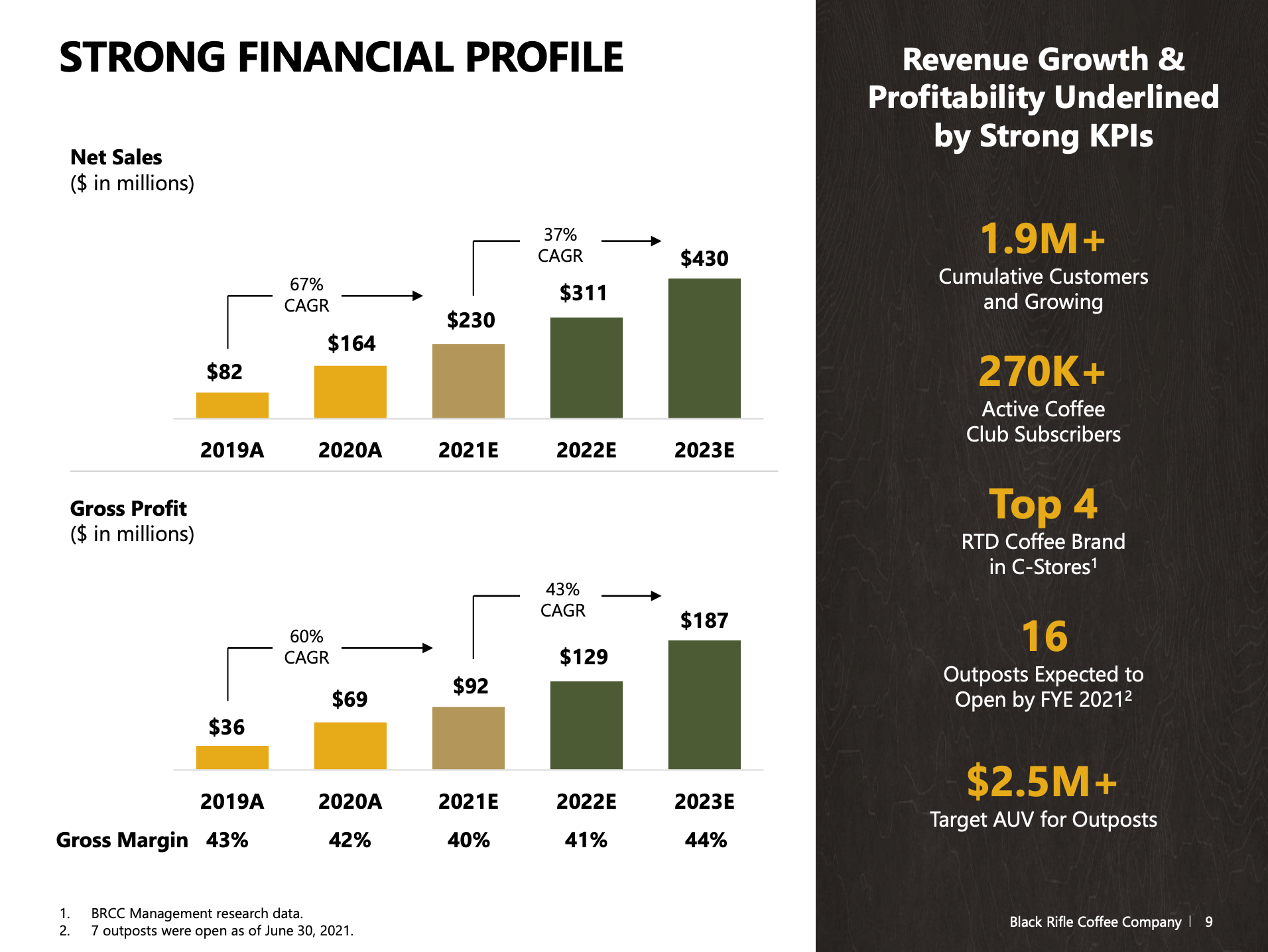

As noted in the graphic below, Black Rifle had

- 2019 revenue of $82MM,

- 2020 revenue of $164MM, and projects it will have

- Estimated 2021 revenue of $230MM,

- 2022E revenue of $311MM, and

- 2023E revenue of $430MM.

And as noted below, Black Rifle is also projecting a significant shift in where and how it generates revenue, moving (it believes) from 84% of its sales coming from the DTC channel in 2021 versus a projected 46% in 2023.

More astounding, however, is its projected 10X growth in Outpost revenue, moving to an estimated 21% of overall sales in 2023 up from just 2% of Black Rifle's expected slice of 2021 revenue.

But projected revenue of $230 million at the end of 2021 is several steps short of a $1.7 billion valuation. Where does that come from?

Enter SilverBox Engaged Merger Corp I.

Another SPAC Merger for a Utah-based Firm

Back in early February, Austin, Texas-based SBEA informed the world of its intent to form a so-called "Blank Check" company when it filed its original Registration Statement for an IPO with the U.S. Securities and Exchange Commission.

Less than a month later, SBEA completed its Initial Public Offering, raising $345 million for its coffers, giving it the juice necessary to begin the process of looking for a likely candidate for the Special Purpose Acquisition Company (SPAC) to acquire/merge with.

As with such SPACs, SBEA's Blank Check company – SilverBox Engaged Merger Corp I – began immediately to scour the country for a likely merger/acquistion candidate.

According to Joseph Reece, Executive Chairman of the Board of SilverBox in his interview with CNBC on November 3 (the day after the SPAC-merger was announced),

"... we started diligencing (Black Rifle) in June."

Now, some four-plus months after due diligence started, that day has arrived.

So when this merger is completed, presuming the deal is consumated, the newly acquired/merged Black Rifle is expected to have a valuation on Wall Street of upwards of $1.7 billion.

And yes, that's a multiple of 7.4X above 2021's projected sales of $230 million.

But not only does everyone involved in the proposed merger believe that $1.7 billion target is in line with other rapid growth, consumer-focused company valuations, the parties actually racheted down the proposed valuation by several hundred million dollars. {Yep, it's in the SilverBox SEC filings.}

Nevertheless, to be clear, this is one of the most complex/convoluted SPAC transactions I have ever encountered, with over 350 pages in the SilverBox Prospectus filed yesterday with the SEC, and with numerous agreements having to take place simultaneously or in cascading fashion for the deal to get done.

But to this non-attorney, it appears that every "T" has been crossed and every "I" has been dotted.

More importantly, post-merger, Black Rifle should have at least $225 million on its balance sheet (at least according to the companies' news release published on November 2).

So ... there you have it.

And if Black Rifle's growth projections are even remotely close to what it foresees for 2022 and 2023, Utah is looking at another multi-billion-dollar valued company on its very near horizon.

So good on ya, Evan and Team Black Rifle. Should be a very, very interesting couple of months.

Author's Note:

For additional details about this proposed SPAC-merger, you may find the following worth your time:

- The transcript of the SilverBox and Black Rifle Investor Presentation delivered on November 2; as well as

- The actual Investor Presentation itself (also published on November 2).