This article was published in the Summit 2021 issue

by Sam Orme and Chris Gammons, Emerging Growth Investment Banking, BofA Securities

We are blessed to live in Utah, a state with favorable regulation, amazing recreation, beautiful vistas, and a hungry and driven workforce.

We are living through the longest running Bull Market in history (which began in 2009 and continues through today), a fact that has benefited Utah more than most other states as the Silicon Slopes economy has driven jobs, wealth, and population growth. In fact, Utah has been the fastest-growing state over the last decade at a whopping 18.4% increase in population. A significant portion of that growth has been driven by Utah’s Financial Services industry which has experienced employment growth of more than 18% over the past five years.

If we continue at this pace, we believe that by 2030 the Utah Financial Services landscape could easily look as follows:

Utah will be a Clear Leader in Mobile Money and FinTech

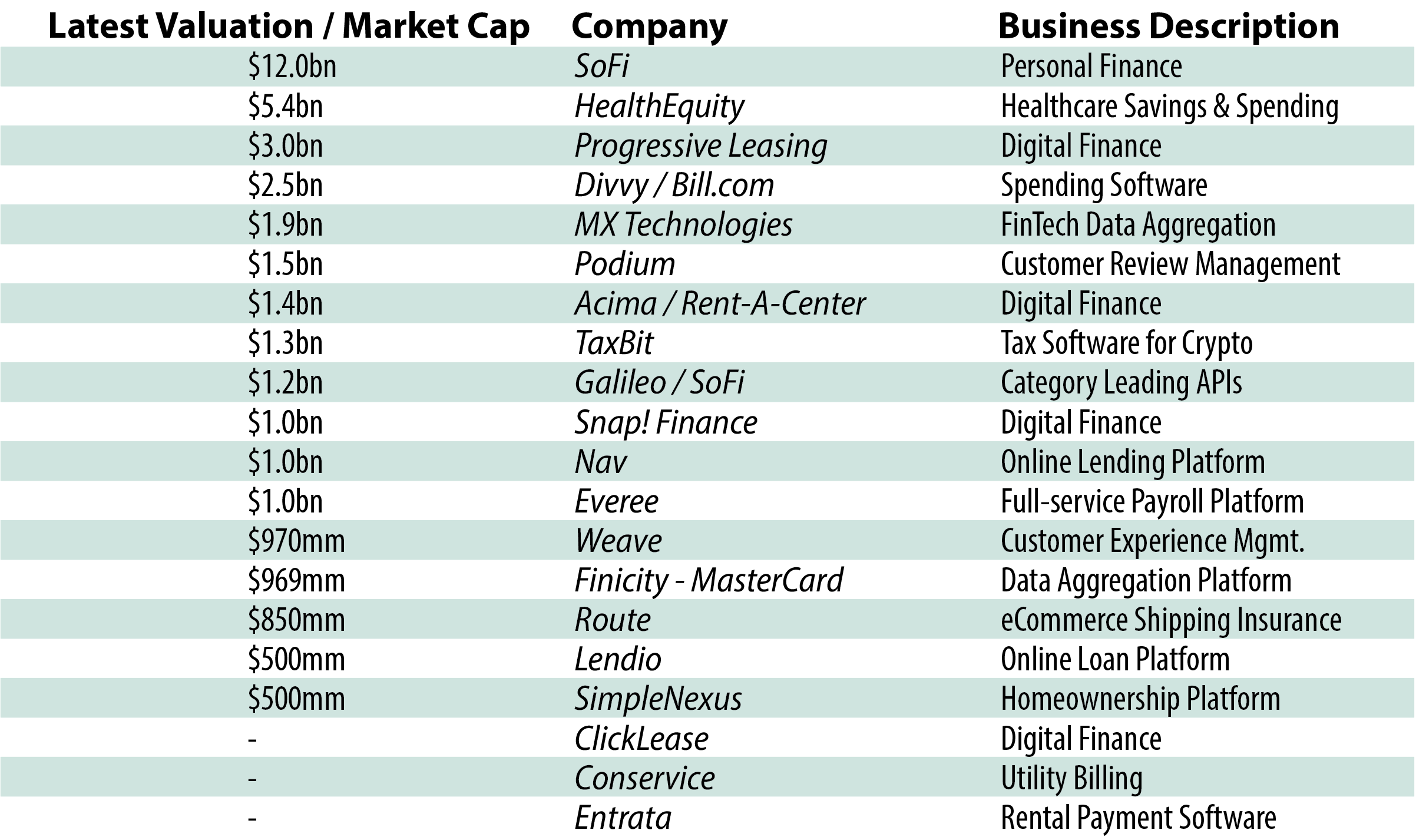

Most Utahns do not realize that Utah is well on its way to becoming a global Financial Technology hub. The API factories of Galileo Technologies, Finicity, MX and others have established roots for the next crop of integrated Financial Services companies, allowing firms to scale faster than ever imagined. Much of Utah’s economic growth has come on the backs of such “FinTech” firms. Over the next 10 years, it is conceivable that over 20 FinTechs will achieve Unicorn status (defined as over $1 billion in value). A sampling of these Utah companies include:

The above companies are well on their way to creating over $100 billion in shareholder value (much of which was created over the last five years). Just think about that? The GDP of all of Greece is only $200 billion.

Utah’s Leadership in Industrial Bank Charters will be a Growing Competitive Advantage

Industrial Banks were first organized under state charters in the early 20th century as local consumer finance companies for industrial workers. These Industrial Banks may be owned by a non-financial institution who are authorized to make consumer and commercial loans and accept federally insured deposits. Utah leads the nation in terms of forward-leaning Industrial banking regulations. Given current trends, it is quite possible that Utah’s Industrial Bank charter may turn out to be the route of choice for FinTech and big tech firms that may benefit from becoming banks. As an example, in March 2020, Square Financial Services became the 16th FDIC-insured Industrial Bank operating in Utah. Other firms seeking (or that currently have) such charters include: Nelnet (student and consumer lending programs), Rakuten (Japanese e-commerce giant), Pitney Bowes (postage meters), and WEX (payment processing). As of December 2020, Utah Industrial Banks had a total of $171 billion in assets.

Utah will Remain the “Most Independent” State

As a people, Americans value independence. We fought hard for it during the American Revolutionary War, and in the present day, we celebrate not only our freedom but also our strong ability to rely upon ourselves as individuals. According to WalletHub, Utah is the “Most Independent State” based on five sources of dependency:

- the government,

- consumer finances,

- the job market,

- international trade, and

- personal vices.

Large corporations looking to relocate continually look to Utah due to low taxes, talented workforce, continued growth of available housing, and friendly business environment. Being independent and having a balanced state budget along with our AAA credit rating will continue to empower Utah to be a destination for corporations around the globe.

Utah will Become a National Financial Services Hub

As Utah’s largest and fastest-growing key industry, the Financial Services sector plays an essential role in the state’s economy. The industry includes commercial and industrial banks, credit unions, everything related to FinTech, insurance enterprises, and other financial service businesses.

What if a decade from now, New York, San Francisco, Dallas, and Salt Lake City are the leading Financial Services hubs for our country? It is not a farfetched notion. One could argue Utah was such a hub back in the 1930s when Marriner Eccles was responsible for many keystones of U.S. monetary policy including a dramatically reformed Federal Reserve System and the FDIC.

This Utah Financials Services renaissance may still be in early innings, but all signs are looking positive. Of the total employee base along the Wasatch Front, roughly 10% work in Financial Services today. Great examples include:

- SoFi, which has now acquired Galileo, continues to expand aggressively through targeted hiring.

- BofA Securities – Two years ago our team added the first “bulge bracket” investment banking group to Utah. Clients utilize services such as private/public capital, M&A, IPOs and Special Purpose Acquisition Companies (SPACs). The team has already made an impact with Utah-based companies like Purple, Overstock.com, Owlet, ICON Fitness & Health, Vivint, Ancestry, and Extra Space Storage.

- Goldman Sachs – Salt Lake is the base of operations for the company’s second largest North American back-office and includes a variety of positions.

- Acima (recently acquired by Rent-A-Center) is a point-of-service leasing company that partners with merchants to provide leasing and purchase options for household products to consumers throughout the credit spectrum continues to expand.

- Wasatch Global Investors – most people don’t realize this firm has almost $40 billion in Assets Under Management (AUM) and is arguably the greatest small-cap investor in the world.

- Progressive Leasing (recently spun-off from Aarons) is the largest and longest-tenured virtual lease-to-own provider in the United States and continues to expand.

Utah is ready for this and has been tailor-made for this Financial Services renaissance. As we look toward the next decade of growth, it is clear to us that Utah’s Financial Services industry will become one of the core guiding lights of the global economy.

Sam Orme is Managing Director for BofA Securities focused on emerging growth and technology clients. He has five kids, still works 80 hours a week, skis his brains out when he can, and calls Utah home.

Chris Gammons is Vice Chairman for BofA Securities focused on private equity and venture capital backed companies and clients. Previously, Chris ran many roles for BofA in Asia, most recently as head of APAC Global Capital Markets. In his downtime, he can be found hiking the hills outside his home in Park City.

Take Our Survey

Hi! The Silicon Slopes team is interested in your feedback. We are asking for a couple minutes to quickly provide feedback on our Silicon Slopes quarterly magazine publication. Click HERE and share your thoughts with us. Your responses will help us improve. Thanks!

*Read the latest issue of Silicon Slopes Magazine, Summit 2021