In roughly 13 years, Sandy, Utah-based Bridge has emerged as one of the top real estate investment and management firms in the world.

Sandy, Utah-based Bridge Investment Group (NYSE:BRDG) has raised $2.9 billion for its Bridge Debt Strategies Fund IV.

According to the news release announcing the funding, Bridge will use the monies to focus on investments in three main areas:

- Originating first mortgage direct loans,

- Investing in Freddie Mac K-Series B-Pieces, and

- Opportunistically investing in other CRE backed debt such as commercial real estate collateralized loan obligations (CRO CLOs).

According to James Chung, Bridge’s chief investment officer for its Bridge Debt Strategies funds,

“Our heavy focus on recession-resistant multifamily collateral and floating rate debt positions the Fund well in the current market environment. To date, we have assembled a durable portfolio and have substantial dry powder which will create the opportunity to deliver strong returns to our investors.”

Bridge Investment Group: A Quick Overview

In case Bridge is not on your radar, it was officially formed in 2009 as a real estate investment firm.

To get an idea of how well Bridge has done in the ensuing decade-plus, consider that Public Equity Real Estate magazine (PERE) ranked Bridge as the world’s 13th largest private real estate firm in June of this year (based upon over $11.2 billion raised during the past five years).

As of March 31, Bridge had over $38.8 billion in assets under management (AUM), and according to Yahoo! Finance, the company generated $760 million in revenue over the last 12 months.

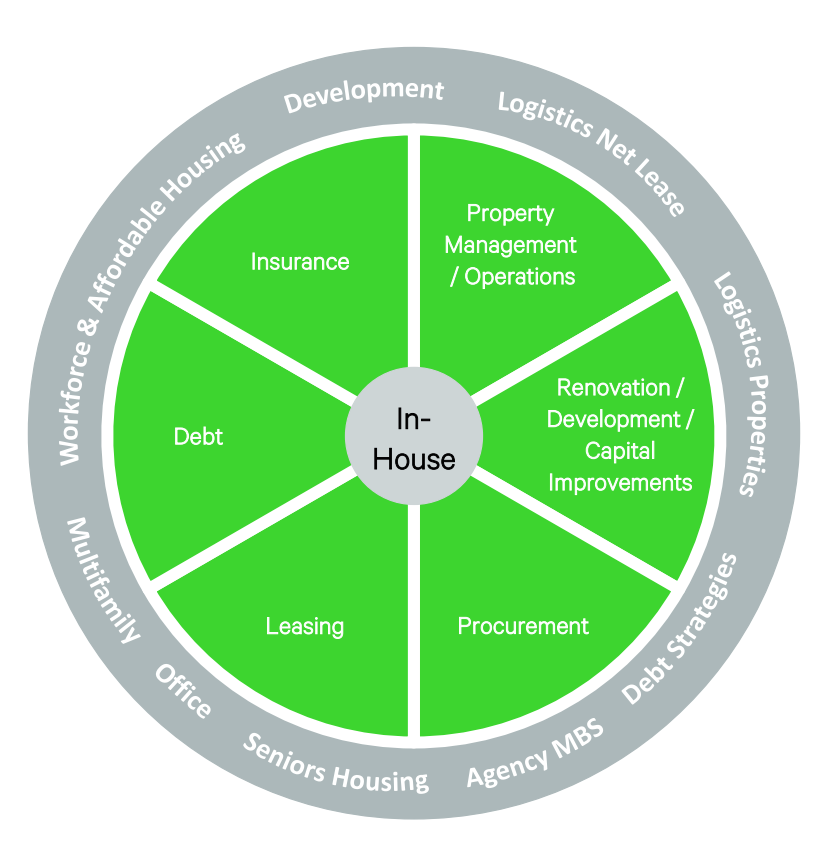

In my mind, Bridge is this interesting agglomeration of real estate, finance, technology, and services.

According to the company’s most recent quarterly report (for the period ended March 31, 2022), Bridge focuses in 10 investment areas, namely

- Multifamily,

- Workforce and Affordable Housing,

- Seniors Housing,

- Office,

- Development,

- Net Lease Income,

- Logistics,

- Debt Strategies,

- Agency MBS, and

- Single-Family Rental.

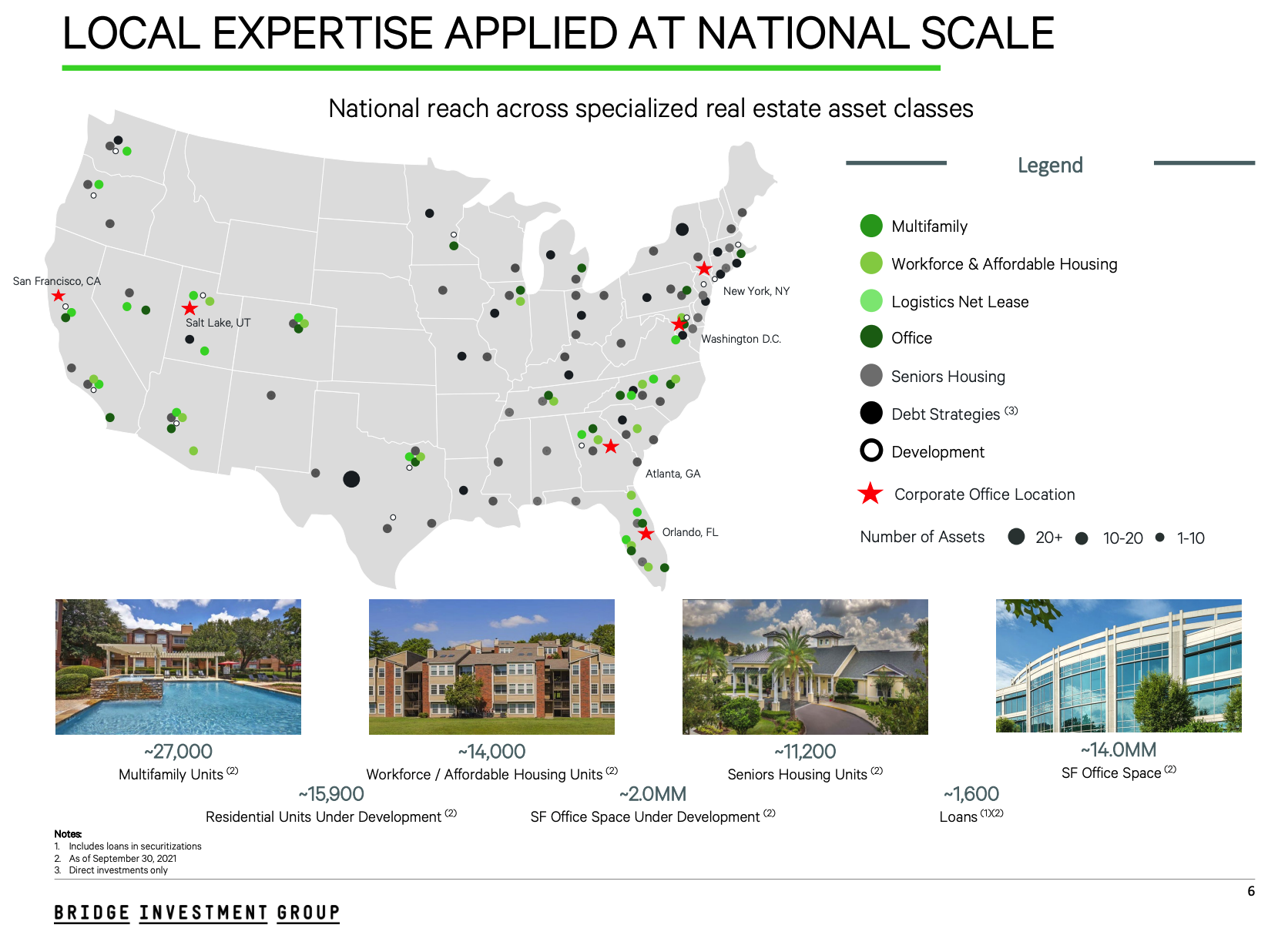

As of 30 September 2021, Bridge had

- ~27,000 multifamily units (aka, doors),

- ~14,000 workforce / affordable housing units,

- ~12,000 seniors housing units,

- ~14 million square feet of office space,

- ~15,900 residential units under development,

- ~2 million square feet of office space under development, and

- ~1,600 real estate-related loans.

Bridge has six corporate offices across the United States, and (as shown in the illustration below), its portfolio is most heavily deployed in the eastern half of the country.