Ask most Utahns to rank what they believe others recall when they think of Utah and chances are you’d get such answers as

- The Utah Jazz,

- The Great Salt Lake,

- Tabernacle Choir,

- “The Greatest Snow on Earth,” and maybe even

- Zion National Park.

The answer you probably won’t get, however, is Banking, right?

Nevertheless, since the late 1990s, Utah has quietly emerged on the national and global scene as a financial center.

It is this monetary emergence that has not only led some of the biggest financial organizations to establish operations in Utah, but has recently convinced one of the world’s most prominent FinTechs to launch a bank headquartered in the State of Deseret.

A Brief Overview of Early Banking in UTAH

With Utah’s acceptance into the Union in 1896, state-chartered banks in the newly declared state of Utah were initially supervised by the Secretary of State.

Eighteen years later Utah’s Banking Department was created to oversee banks operating in the state, and this agency remained in place as such for 55 years until it was renamed in 1967 as the State Department of Financial Institutions, its name today.

Put in simplest terms, the DFI has responsibility to

“… charter, regulate, and supervise persons, firms, corporations, associations, and other business entities furnishing financial services to the citizens of the state of Utah.”

Over the past 50+ years, the legislature has advanced the laws and regulations in the state to the point that Utah has attracted a surprisingly high amount of name-brand banks and other financial institutions to the state, especially given its relatively small population of 3.2 million residents.

Case in point, consider the following financial institutions with operations currently in Utah:

- American Express,

- Bank of the West,

- Bank of America,

- Goldman Sachs,

- JPMorgan Chase,

- KeyBank,

- Morgan Stanley,

- Synchrony,

- U.S. Bank, and

- Wells Fargo,

just to name a few.

And yes, they’re some of the largest and most recognized banks on the planet.

According to DFI, it presently oversees and regulates nearly 120 state banks, national banks, credit unions, and other financial organizations operating or headquartered in Utah.

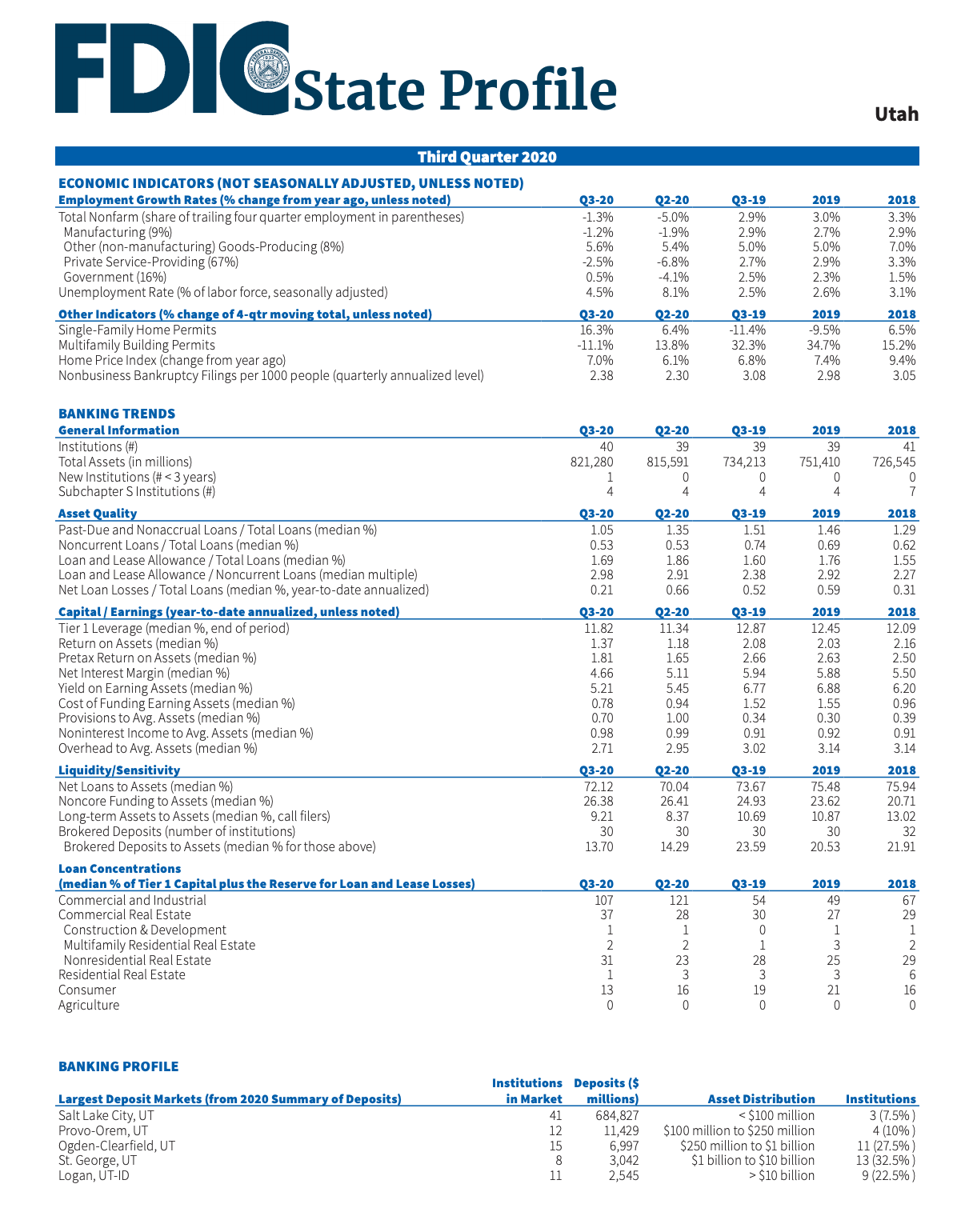

It turns out that Utah places about right where one might expect it to rank on a total deposits basis — No. 9 in the country — placing behind such states as Ohio, South Dakota, North Carolina, New York, and Delaware (the Top 5, in order, in the U.S.).

But here’s where it gets interesting.

When you analyze the latest FDIC data on a metropolitan basis (Q3 2020), the Wasatch Front (aka, Ogden to Provo/Orem) comes in at total deposits of $703 billion, placing it only behind the New York City metro (at $2.3 trillion) and the Sioux Falls, S.D. area (at $771 billion). [South Dakota also has favorable banking laws, hence the high deposit levels.]

{NOTE: In case you were wondering, the San Francisco Bay Area and greater Los Angeles regions both land slightly behind the Wasatch Front with deposits of $691 billion and $676 billion, respectively.}

From my perspective, how the Wasatch Front landed at the No. 3 market for bank deposits in the U.S. is all tied to the fact that Utah has become the top home for Industrial Banks in the country.

Utah’s Role in Industrial Banking

Unless you work in the financial sector or for the state’s Department of Financial Institutions, you’ve probably never even heard of an Industrial Bank, (also known at times as an Industrial Loan Company). And yet IBs have been around since 1910.

According to the DFI,

“A Utah-chartered Industrial Bank (IB) is an institution subject to the same regulatory oversight as a Utah-chartered commercial bank.”

In simplest terms, an IB does not need to be owned by another bank (or even a financial institution). Yet it may function in the “banking business” as defined by Utah banking laws dating back to 1953, including offering loans to individuals/businesses and collecting deposits.

Nevertheless, to do so, an IB must be insured by the FDIC (the U.S. Federal Deposit Insurance Corporation).

Although IB’s are authorized in over half of the states in the country, six states have active IB-charters, with Utah and Nevada leading the way for Industrial Banks. And as it turns out, Salt Lake City is home to the primary organization supporting the IB industry — the National Association of Industrial Bankers.

The NAIB is led by noted Utah lobbyist, Frank Pignanelli (of Utah’s top government relations firm, Foxley & Pignanelli), a role that Pignanelli has held since 2004.

Based upon my research, Industrial Banks seem to fall in and out of favor, often in near concert to the political winds of the day of greater or lesser regulatory oversight. But under Pignanelli’s direction, it appears that the IB industry has done well.

As of today, DFI notes that 16 IBs are based here, more than any other state.

FinTechs in Utah, Square, and “Square Bank”

As it turns out, IBs are not the only financial institutions doing well in Utah as the flowering of the aptly named Silicon Slopes has given birth to, or attracted, an entire flock of so-called FinTechs (short for Financial Technology firms).

Outlined below is an alphabetized list of just a few of the FinTechs headquartered in Utah (or with major operations in the state):

- Divvy (highlighted in the 01-14-21 issue of Deseret Business Watch);

- Everee (raised $10 million in a Series A round in April 2020);

- Finicity (acquired in November 2020 by MasterCard);

- Galileo (acquired in April 2020 by SoFi);

- Lendio (raised $55 million in a Series E round in February 2020);

- MX (also highlighted in the 01-14-21 issue of Deseret Business Watch);

- NAV (closed a $45 million Series C round in late 2019);

- QubeMoney (raised $4+ million in seed funding);

- SimpleNexus (also highlighted in the 01-14-21 issue of Deseret Business Watch);

- Snap! Finance (has raised over $34 million);and

- Spiff (raised $10 million in a Series A round in January 2020),

among others.

And let’s be clear about this: A bank or financial institution that does NOT implement such technology services and tools as mobile apps and eChecking is in the Dark Ages. So (in essence) virtually every Utah-based bank / financial institution is also a FinTech.

So, not surprisingly, I took notice last March when the DFI announced that it had approved the state-charter for massive FinTech Square to open an Industrial Bank in Utah. {NOTE: This state charter approval occurred in tandem with the FDIC’s conditional approval to provide deposit insurance for this new IB.}

According to the official Square news release, its IB is called Square Financial Services, and at the time of the announcement, the expectation was that its doors would open for business sometime in 2021.

With its choices for the top leadership positions of Square Financial Services, Square has (in my opinion) “hit the ball out of the park,” naming as its CEO and CFO two financial execs with a depth of industry experience and deep ties to Utah.

Case in point, Lewis Goodwin will serve as its Chief Executive Officer, a University of Utah alum (bachelor’s degree) with over 35 years of executive banking and financial industry experience.

And although his LinkedIn Profile only names him as “Banking Service Lead at Square,” do not be confused; as someone who was the CEO or CFO of

- Green Dot Bank,

- Chrysler Financial Bank,

- DaimlerChrysler Bank, and

- Toyota Financial Savings Bank,

Lewis is DEFINITELY the CEO of “Square Bank.”

Additionally, Brandon Soto has been tapped to be the Chief Financial Officer of “Square Bank.” And not only is he an alum of both Westminster College (MBA) and the UofU (bachelor’s degree), but he has 20+ years in the banking and financial services industry, including executive positions with

- Green Dot Bank,

- Sallie Mae Bank,

- Chrysler Financial Bank,

- Allegiance Direct Bank, and

- Toyota Financial Savings Bank.

[Yes, their careers have overlapped.]

Since March, however, I can find zero official announcements or news tidbits from Square or Square Financial Services about what is happening with this new Industrial Bank. Bupkis!

Now, obviously, the entire world has been dealing with the economic fallout from the Covid-19 pandemic. So I’m not totally surprised.

And in the world of banking, organizations tend to be a bit more tight-lipped when it comes to publicity and marketing activities, especially in advance of a launch, and often when the parent company is publicly traded.

However, a search of registered businesses on Utah.gov shows Square Financial Services, Inc. as a legal entity in the state.

So although neither Square Financial Services or Square are named on the BFI website today as an operating Industrial Bank in Utah, I suspect it’s simply a case that the company has not officially opened its doors for business.

Yet.

That said, a quick dive into LinkedIn shows that Square already employs over 30 people in Utah. And that’s on top of six additional Square employees based outside of the state who include Square Financial Services in their respective job descriptions.

So … when is “Square Bank” gonna “Go Live?” I have no idea.

And given the company’s tight-lipped-ness about its IB, let alone that Square will be releasing its Q4 and full-year 2020 results on February 23rd, I know better than to waste my time reaching out to the company because it’s smack-dab in the middle of its Quiet Period.

But … given the facts that

- Square is the hottest FinTech on the planet;

- Its stock price is up over six-fold since March 2020;

- It was sitting on $2.88 billion in cash at the end of its most recent quarter; and that

- Square has the regulatory Green Lights it needed from both the FDIC and Utah’s Department of Financial Institutions …

this thing will happen. It’s just a matter of time.

My guess? Within the next 60—90 days. But … that’s just a guess.

But when it does, watch out.

“Square Bank” is gonna be a rocket ship headed “up and to the right.”

And that will be good for the business community in Utah.

NOTE: This article was originally published by Deseret Business Watch. A few minor editorial changes have been made to this version vs. the original to better match the current Silicon Slopes writing style.