The news is fairly straightforward: Salt Lake City-based Aumni announced this morning that it has raised $50 million in a Series B round of funding led by J.P. Morgan.

Also participating in the Aumni funding of its "industry-leading investment analytics platform" was SLC-based Pelion Venture Partners.

Pelion was joined in the funding round by five other new investors - WndrCo, Citadel Securities, Invesco Private Capital, Vanderbilt University and Kera Capital Partners - as well as existing investor, Cottonwood Heights-based Mercato Partners through its Prelude Fund.

{UPDATE: Turns out that Kera recently opened an office in Park City. Additionally, another prior investor, Cottonwood Heights-based Kickstart Fund, also invested in Aumni's Series B round of funding. So a total of 4 Utah-based investors participated in this investment round: Kera, Kickstart, Mercato, and Pelion.}

According to Michael Elanjian, Head of Digital Innovation, Corporate Investment Bank, J.P. Morgan, "Our strategic investment in Aumni will allow the company to continue to capitalize on its impressive growth trajectory, unlocking data insights that have historically remained inaccessible in the private markets."

So what is it that Aumni does that has allowed it raise over $66 million in total since its formation in 2018? We'll get to that in a moment.

The Role of Disruption in Changing the World

If one thing has become clear to me during my 35+ years of working in the technology, business and investment worlds, it's this ... every single industry is open for disruption and a new approach to how things are done IF you can get the right people and the right idea and the right technology(ies) in place at the right time.

This concept was first proven over 55 years ago when Intel Co-Founder, Gordon Moore, postulated with his eponymous Moore's Law that the capabilities of semiconductors would double every 24 months, while the cost for such computer chips would be halved every two years as well.

In a similar vein, Metcalfe's Law suggested that the value of any network (physical and/or interpersonal) would rise dramatically as more nodes or people were added to that network, as shown by the equation of n(n -1)/2.

The truth of these and other technology / business "laws" have been proven over and over during the past half century, giving birth to such transformative advancements as the World Wide Web and the ability to own/use a telecommunications supercomputer small enough to fit into a pocket (aka, a smartphone).

So ... what niched yet critical aspect of business is in the process of being totally disrupted by Aumni? It's the data aspect of the legal requirements of venture capital and private investing.

Modern-day Investing and the Law

It turns out that the birth of modern day venture capital and private equity investing traces back to the mid-19th century and really began apace in the 1970s with the first VCs on Sand Hill Road in Silicon Valley and their counterparts along Route 128 in the greater Boston area.

But for most Americans, their first exposure to investing likely ties back to their early grade school days when they learned that Queen Isabella convinced the King of Spain to fund the outrageous plans of one Christobal Columbus to find a new sailing route to China. {And to be clear, financing the Nina, the Pinta, and the Santa Maria was definitely an investment, one made by España.}

Although much is made of the multi-million-dollar, even centi-million-dollar, investment rounds placed with Silicon Slopes-based companies and other firms around the globe, the reality is that changes to the American legal system through the JOBS Act and birth of equity crowdfunding have democratized investing in ways never seen before.

However, when Aunt Sally and Uncle Bob approach you about investing in their new bodega or your neighbor is looking for $250,000 in capital to fund his new app, all of a sudden such investment opportunities also have a legal side to them.

And if the legal side is done wrong, incompletely, or not at all, not only is your investment at risk, so is the company you just invested in.

Along Comes Aumni to Change the Way Investors, Attorneys, and Entrepreneurs Approach the Legal Side of Investing

This is why attorneys get paid the big bucks to pull together all of the legal documents required for entrepreneurs to prepare their firms to go out and raise money.

Such documents are even as basic as setting up the proper corporate structure to be able to sell ownership in a firm in the first place, let alone the specificity required in docs for a funding, such as the $50 million Aumni just raised. And the reality is that much of the work that goes into investing documentation is mind-numbing at best.

So after more than half-a-decade apiece of working in securities law, a number of those years spent respectively at Wilson Sonsini, Goodrich & Rosati (arguably the top securities and venture law firm in the U.S.), attorneys Anthony Lewis and Kelsey Chase decided it was time to join forces to fix what they saw as a broken system using big data and artificial intelligence.

Hence was born Aumni, a nod to the acronym AUM (aka, Assets Under Management), a term quite familiar on Wall Street and in financial circles.

The premise behind Aumni was relatively simple:

Can we leverage AI and machine learning with subject matter expertise to provide investors, attorneys, and entrepreneurs with a better process for analyzing, understanding and producing securities documentation?

As it turns out, the answer is Yes.

Simultaneously Helping Investment, Finance, and Legal Teams of Private Capital Investors and at Law Firms

According to today's news release, "Aumni is an investment analytics platform for private capital markets that includes venture funds, family offices, university endowments, and corporate venture firms. By combining the best of AI and human expertise, Aumni’s platform extracts and analyzes critical deal data buried in dense legal agreements, (including) ... comprehensive insights regarding every investment’s financial and legal position."

In simplest terms, all investment docs are scanned into the Aumni platform where they are analyzed by both Aumni's algorithms and by experienced legal professionals to assess the completeness and accuracy of the submitted data.

When aggregated across an entire portfolio of funded entities and/or investment funds, Aumni provides investment teams with an online dashboard of Investment Statistics at both a fund- and a funded-entity level.

Similarly, Aumni empowers investor finance teams with instantaneous access to detailed deal information, data that has been examined using AI and audited by experienced venture attorneys to audit every doc for accuracy and completeness. This allows rapid production of transaction ledgers, summary reports, and access to co-investor data.

Aumni delivers at-a-glance access to legal teams of portfolio legal data, including categorization across more than 40 verified, audited, and accurate data points, as well as secure digital storage of all legal documents accessible from any web browser.

Last of all, when it comes to investment analysts, Aumni delivers an interactive timeline view and allows visualization of liquidation preference terms across

- Seniority levels,

- Equity class compositions, and

- Participation and conversion ratios.

Case in point, since its founding, Aumni has partnered with the National Venture Capital Association (NVCA) to analyze and extract financial and legal investment data representing over $1 trillion in AUM across more than 100,000 distinct venture transactions from over 40,000 investors.

And the insights gained were fascinating.

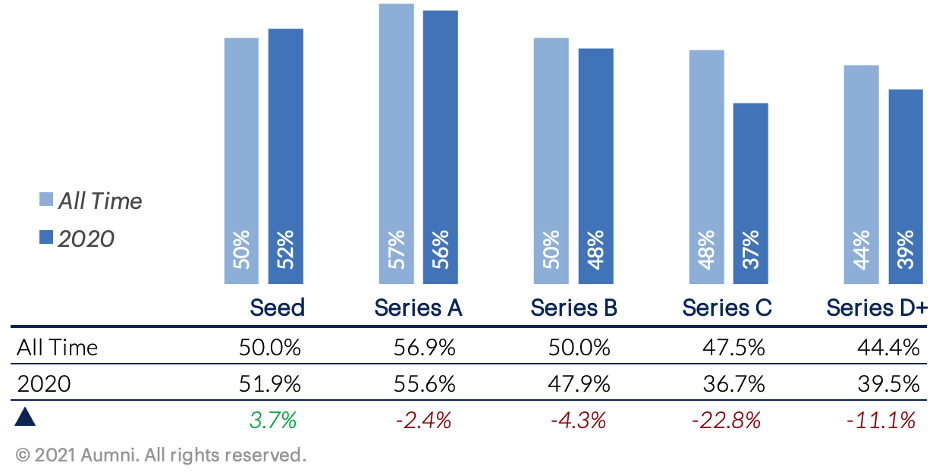

Case in point, what is the median Percentage of Shares Purchased by Lead Investors per round of funding? Turns out the answer varies, from a high of 55.6% for Series A leads to a low of 36.7% for lead investors in Series C rounds.

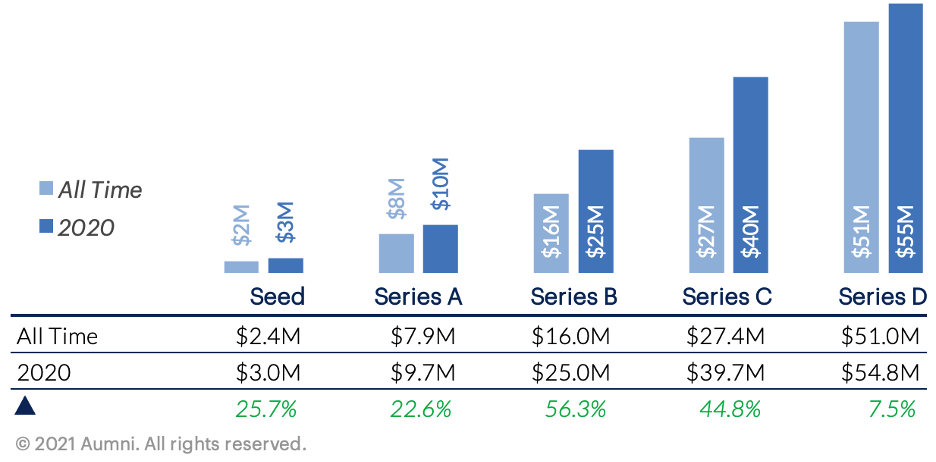

Additionally, what's the Median Amount of Money Raised in an equity funding? Turns out that in 2020 the Series B rounds saw the greatest increase vs. "all time" Series B fundings with growth of over 56%.

Interestingly, when it comes to Post-Money Valuations, the Aumni system found that the greatest increase had come in Series C rounds at nearly 57% vs. fundings in the years before 2020.

{NOTE: The NVCA/Aumni Report is available for free here. In addition, the Report contains a free "Enhanced Model Term Sheet."}

According to Lewis, Aumni CEO and Co-Founder, "When we launched Aumni four years ago, we understood that access to structured data in the private capital markets simply did not exist at scale. Today, Aumni remains the only analytics solution able to correctly model the legal and economic foundation of these transactions."

Additional Implications of Aumni's AI-driven Analytics

During my video conversation last week with Chase, Aumni President and Co-Founder, it became clear that some of other benefits to implementing the Aumni system included speed, accuracy and access to new insights.

Additionally, as Aumni prepared to go out to raise this new round of funding, it accessed the industry data it had already aggregated and analyzed to help it obtain a highly precise understanding of appropriate valuations and terms for companies its size and place in its business lifecycle.

In other words, by "eating its own dog food" (my terminology, not Aumni's), the company was able to dispassionately position itself and its valuation from a logical, data-driven viewpoint, removing emotion from the process.

To be clear, Aumni's platform is not targeted at entrepreneurs today.

But it will be sometime in the not too distant future.

And when it is, I expect we'll see an even greater level of adoption and an acceleration of change within a corner of the investing world dying for disruption.

And that is a good thing.

{NOTE: The video below showcases an interview of Aumni President, Kelsey Chase, by my colleague, Garrett Clark at Silicon Slopes StartFEST in early July 2021 that provides an even more in-depth overview of Aumni and its benefits. Enjoy.}