This article was published in the Winter 2020 issue

by Taylor Bench, Managing Director, Summit Venture Studio

What group invests the most money into pre-seed/pre-revenue opportunities in Utah? Is it a local angel group? No. Is it a secret family office? No. Is it a local accelerator or a local Seed fund? Nope. Is it Y combinator or Tech Stars or the Pentaverate? No, no, no.

Even as a former tech fund analyst and investment banker I didn’t know the real answer to this question. Until I spent 10 years working at the University of Utah Technology Transfer Office (PIVOT Center) did I find the answer. It is a bit of a trick question, but the answer to “who is the largest pre-seed/pre-revenue investor in Utah?” is actually the United States Federal Government.

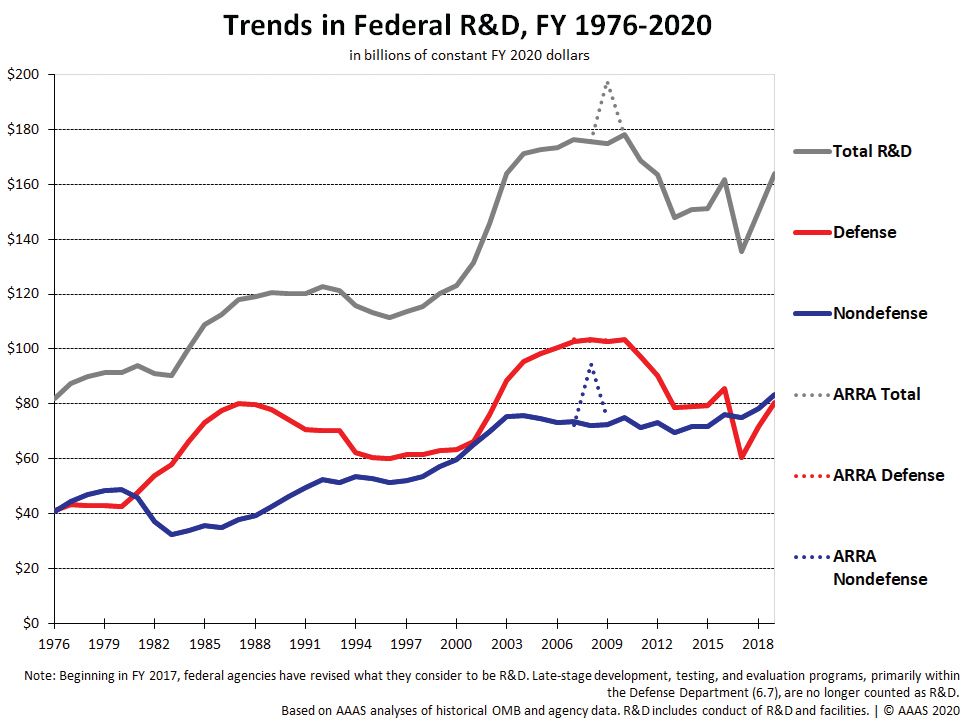

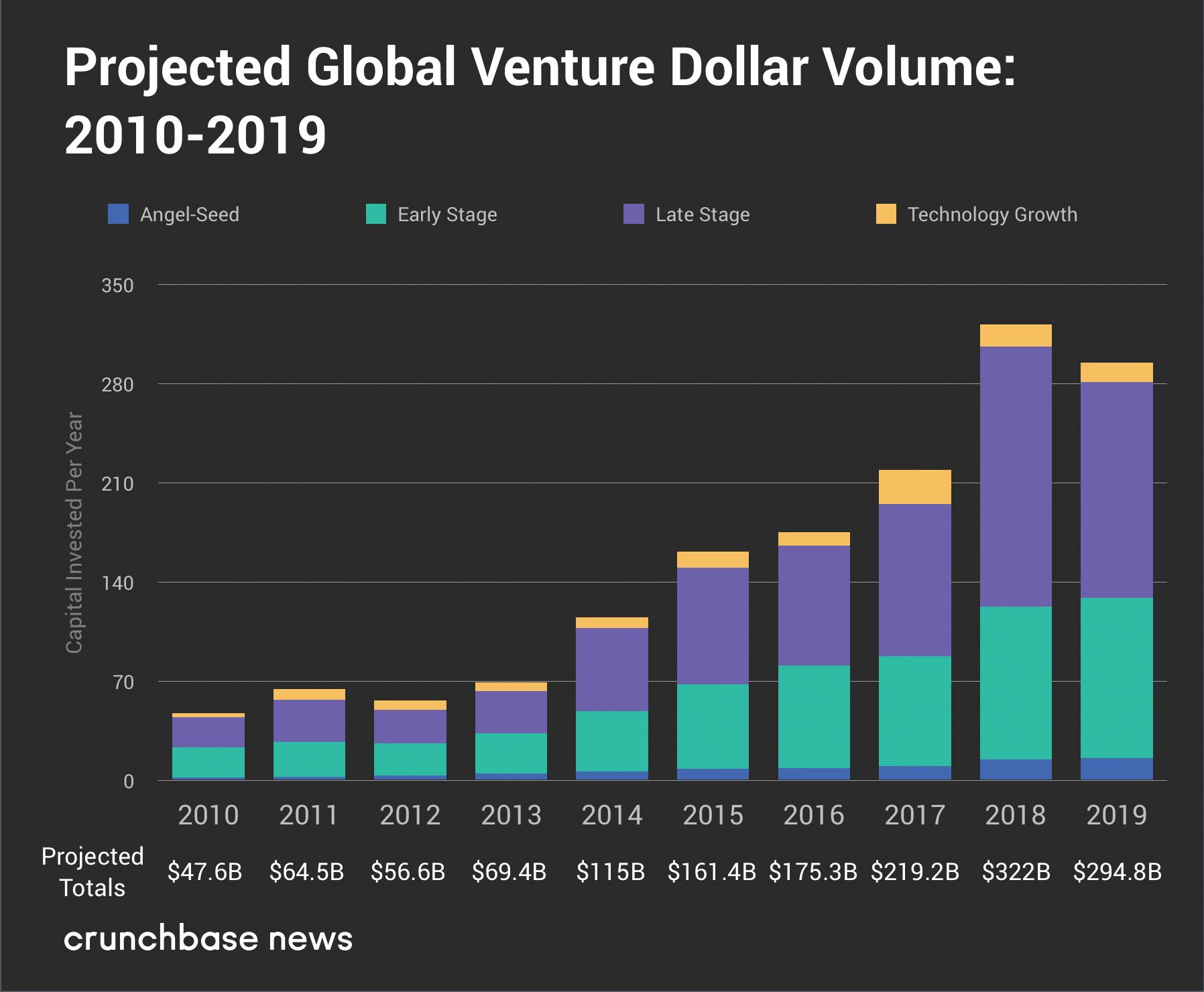

Over the last 15+ years the United States Federal Government has spent between $136-$176 Billion dollars each year on Research and Development. For context, just compare the “Angel-Seed” dollar amount and Federal Research and Development investment amounts over the last 10 years in the two charts below. The Government investments are almost an order of magnitude greater than the Angel-Seed investments each year.

Where does that money go? What are they investing in? Much of the money goes to research institutions and Universities. The local Universities in our state get almost $1 Billion per year from these Government research and development dollars.

The funds are given to researchers and faculty at the Universities who then perform basic research and generate hundreds of new and amazing innovations each year. Have you heard of Recursion, Biofire or Cephalon (if not, check them out)? All of them are based on University technologies. It isn’t just Health Sciences technology either. Utah State University is second in the nation for aerospace funding and also holds the world record for the most student experiments sent into space (https://www.usu.edu/degrees/index.cfm?id=50).

During my time at the U of U between 2009 and January of 2020 I met with hundreds of inventors. Collectively, these inventors received more “pre-seed” capital than any investment group in the state has invested…ever.

I share the examples above fully knowing that the funds coming from the federal government are not exactly like “true investment dollars”. The purpose of these research and development funds are not meant to create an impressive Return on Investment (ROI). The government doesn’t end up in the top quartile of returns for Venture Capital (VC) firms. The funds are provided to increase knowledge and create new ideas and solve big problems. Problems that may not make sense for VCs to consider because of their speculative and high-risk nature. Also, many of the technologies created are actually solutions looking for problems and never find a home outside of a published article.

HOWEVER…

Even if the intent and method of “investing” almost $1Billion into Utah is not exactly geared toward creating an ROI, there is still HUGE value created from these Government “pre-seed investments”. The catch is how to unlock and liberate the value created from our local Universities? It isn’t easy. There is certainly a bureaucratic wall to climb dealing with public institutions. The opportunities are not often shiny and ready for the market. There is no secret drawer at the Universities where “the good stuff” is kept. You have to roll up your sleeves and dig for it. You have to figure out what a business model and unit economics could be for the newly invented, amazing widget. You have to find the customer for the concept that a researcher created after spending a $2 Million (or more…or less) grant from the government. After all of that you have to figure out how to license the technology from the University into your company. Only then can you work to produce, scale and sell that new technology or product.

Is it worth it? All that hassle through the bureaucracy to get a new technology that isn’t even market ready out of the University? Why go to all that work? Is there enough Excedrin in the world to make that bearable? Who would do that?

Well… I would. I actually left my stable job of 10 years at the University of Utah in February to do it. So, the answer to the question “who wants to work with the largest pre-seed investor in Utah?” – right now, it’s me. Am I a successful entrepreneur sharing my story in this article? Not yet. Do I have a clever road sign on I-15? Nope. Do I believe in the idea of working with multiple Universities to leverage millions of dollars in government grants as the initial seed capital of a portfolio of technologies? I do. This experiment is happening in real time.

Take Our Survey

Hi! The Silicon Slopes team is interested in your feedback. We are asking for a couple minutes to quickly provide feedback on our Silicon Slopes quarterly magazine publication. Click HERE and share your thoughts with us. Your responses will help us improve. Thanks!

*Read the latest issue of Silicon Slopes Magazine, Winter 2020