It would be easy to drop a sardonic eye-roll after skimming this headline, along with a sarcastic, under-the-breath "meh" for what FinWise Bancorp has accomplished.

A $42 million Initial Public Offering?!?! And the company netted under $36 million? Don't make me laugh. Utah has thousands of companies that have raised that much money in their Seed Rounds.

Well ... not really. But it feels that way, right?

Except that would be totally missing the point.

And that point is this – in any industry in any locale throughout the State of Silicon Slopes, or across the USofA, anyone and any company with a great idea and enough willpower and hard work can be successful.

And maybe, just maybe, they might go on to become a really big deal.

To be clear, FinWise is a small, Utah-incorporated bank holding company with

- Its headquarters in Murray, Utah,

- A single full-service location in Sandy, Utah, and

- A loan production office in a Long Island, New York village known as Rockville Centre.

That's it.

In other words, on the surface, FinWise is a pretty boring bank holding company.

But as I dug a bit further into its history, a potentially interesting backstory began to emerge.

In fact, I believe, the still-unfolding, still-evolving story of FinWise Bancorp is what makes this boring bank worth diving into.

The Inauspicious Birth of FinWise

The birth of what became FinWise Bancorp actually occurred some 23 years ago way back in 1999 with the formation of Utah Community Bank.

Clearly it was not a very imaginative brand name for the Murray, Utah-based institution given that it primarily focused on real estate lending in the Salt Lake metropolitan area, the essence of a community bank.

A few years later a new firm, FinWise Bancorp, was formed and it acquired 100% of the stock of Utah Community Bank in 2002.

All went swimmingly for FinWise, so to speak, until the Great Recession years of 2008 – 2010.

Like many banking institutions focused on real estate lending in the "If you can fog a mirror, I'll give you a mortgage" days of Collateralized Debt Obligations and other now nonsensical lending practices, FinWise had experienced considerable asset quality issues in the mid- to late-2000s.

Hence, it was not surprising that FinWise got slapped with a Cease and Desist Order from the Federal Deposit Insurance Corporation (FDIC) on July 15, 2009.

To be clear, FinWise wasn't the only Utah bank to run afoul of the FDIC during the Great Recession, with the Salt Lake Tribune reporting that at least 25% of Utah's banking institutions at the time were ordered "... to clean up their books."

At the end of 2010, FinWise had a miniscule $32.4 million in assets.

But before the end of 2010, FinWise named Kent Landvatter as the company's new president and CEO.

His bona fides? Landvatter had 30 years of banking industry experience under his belt when he was brought on board, and among other roles, he had served previously as the president of both Comenity Capital Bank and Goldman Sachs Bank, USA.

In addition, Landvatter had deep ties to Utah, having earned both his bachelor's degree and an MBA from the University of Utah.

So what has Landvatter done for FinWise in his 10-plus years at the helm? A fair amount, actually.

AUTHOR'S NOTE: Although this is known as "burying the lede" in the journalism field, FinWise Bancorp officially became a publicly traded company two weeks ago on Friday, November 19, netting approximately $35.6 million from its Initial Public Offering by selling just over 4 million shares to the public at $10.50/share.

As a result, an investor relations spokesman was kind enough to inform me last night that FinWise (NasdaqGM:FINW) was still officially in its "Quiet Period," which meant its CEO and other executives/spokespeople were unable to "speak to the press" (aka, to me) in connection with this or any other story until roughly mid-December.

Hence, the reporting for this article is primarily based on publicly available material, as well as my own interpretation of such information.

Landvatter's Transformation of FinWise

Out of the gate, Landvatter had two tasks at hand:

- The first was Urgent and Important (getting the FDIC's Cease & Desist Order lifted), while

- The second was Not Urgent but Important, at least not immediately so; that was defining and beginning to implement a Strategic Plan to get FinWise kickstarted.

According to the FinWise Form S-1,

- The Cease & Desist Order was lifted in August 2011.

- Similarly, FinWise launched its Point-of-Sale lending program in 2011 as well.

By 2014, FinWise pulled the trigger on two transformational decisions:

- It decided to launch an SBA (7)a Lending Program, while

- Simultaneously (or nearly so) it entered into what has become a massively critical strategic relationship with Business Funding Group, LLC out of Stamford, Connecticut, a "creative financing solutions" company.

This relationship with BFG now drives the vast majority of FinWise's Small Business Administration (SBA) Loan business, so much so that the SBA's website ranks FinWise as the 37th most active SBA 7(a) lender in the country for the first nine months of 2021, at 150 loans originated worth $204 million.

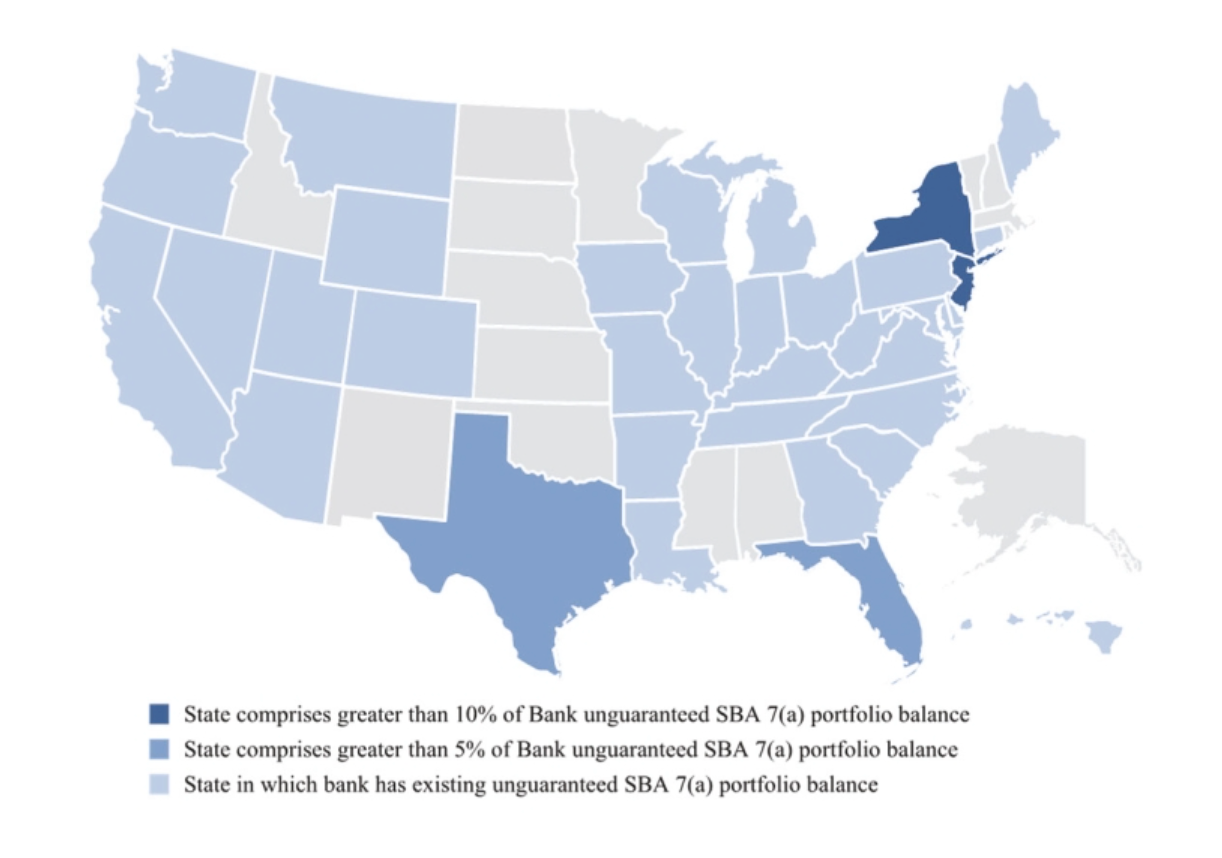

In fact, Landvatter explained to PYMNTS.com that FinWise ranks today as a Top 10 SBA 7(a) lender in both New York and New Jersey.

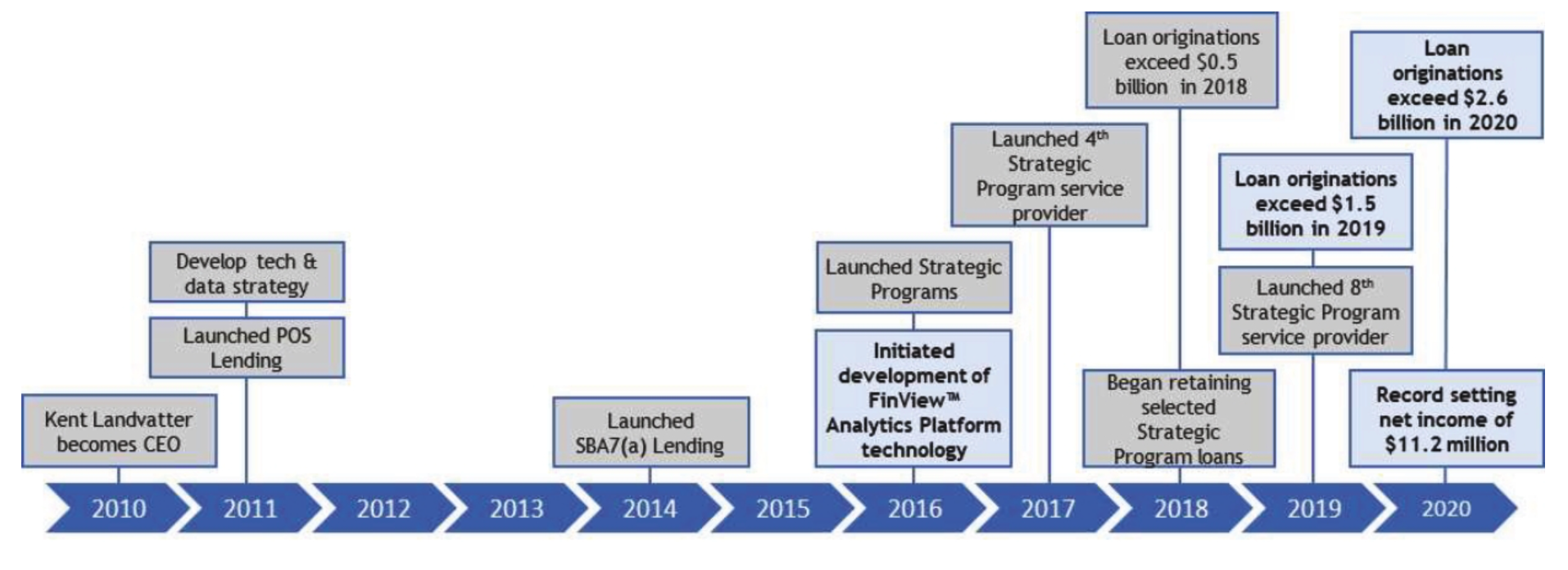

To provide some additional context to the progress achieved by the company since the arrival of Landvatter in 2010, check-out the somewhat crudely created graphic below for a 10-year timeline of milestones (taken from the final FinWise Prospectus).

During this 10-year horizon, it's clear that Landvatter also recognized the need to build out a winning team to help him elevate the FinWise game. Cases in point, here is a brief overview of some of the senior most people he brought on board to FinWise during the past decade:

- March 2015: Javvis Jacobson, Executive Vice President and Chief Financial Officer (20-plus years in the financial services industry, including Deloitte and CFO of Beehive Credit Union with over $190 million in assets);

- March 2016: David Tilis, currently the Senior Vice President and Chief Strategy Officer (over 15 years of banking experience, including Union Bank of Switzerland, Cross River Bank, and UBS);

- February 2018: James Noone, EVP and Chief Credit Officer (20 years of financial services experience, including six years as EVP of Prudent Lenders, an SBA service provider);

- March 2020: Dawn Cannon, Chief Operating Officer and EVP (her LinkedIn profile says she has two decades of banking experience, including over 16 years as the EVP of Operations of EnerBank USA here in Utah); and

- September 2021: Michael O’Brien, EVP, Chief Compliance and Risk Officer, and Corporate Counsel (over 20 years of legal, compliance and risk management experience in financial services, including legal positions with E*TRADE Financial and Sallie Mae Bank, plus serving as served as Chief Compliance Officer of EnerBank USA, as well as Bachelor's and Master's degrees in Philosophy from the University of Utah).

Returning briefly to the timeline above, there are four items I would have you pay attention to on that graphic, the first three of which are highlighted. The fourth item, however, is not included above.

- ONE: The 2014 launch of the SBA 7(a) lending program;

- TWO: The beginning of development of the FinView Analytics Platform in 2016;

- THREE: The fact that FinWise's loan originations exceeded $2.6 billion in 2020; and

- FOUR: The missing notation of the start of the relationship with BFG.

The BFG Magical Mystery Tour: How Much is BFG Actually Worth? And Why Does this Matter to FinWise and its Investors?

The reason I posit these questions about BFG has to do with the fact that there is actually cross-ownership between BFG and FinWise.

Presuming that I've read the final FinWise Prospectus correctly, the Murray-based bank

- Has acquired a 10% ownership position in BFG; while

- Also selling over 25% of its own outstanding shares to BFG (post-IPO); yet FinWise

- Has also negotiated the right of first refusal to acquire BFG. {Please note that terms are not disclosed surrounding such purchasing rights.}

Did you catch all of that?

As a privately held company, it's naturally tough to get an actual handle on a possible valuation for BFG.

But on the BFG website, the Connecticut company shares the following:

"Since our founding in 2012 we have accomplished over $2 billion in loans. This includes $800 million in SBA loans ranging from $100K to $14 million and over $1.5 billion in sophisticated structured financing deals from $25 million to over $200 million."

Better yet, buried on page 105 of the FinWise Prospectus is a Table highlighting Non-Interest Income comparisons for the nine months ended Sept. 30, 2021 and Sept. 30, 2020, respectively.

And for the most recent nine-month period, the 10% ownership position FinWise holds in BFG is pegged at $2.127 million.

So if my math is correct, that puts the BFG valuation at ~$21.25 million (as of Sept. 30, 2021 at least).

Interestingly, 50.6% of FinWise's non-guaranteed SBA (7)a loan balances, as of the end of September, are from New York and New Jersey transactions, which, of course, just happens to be in BFG's backyard.

I believe it's also further testament of the strength of the FinWise/BFG relationship and the potential for FinWise to drive both more revenue, and to do so more profitably, through its ties to BFG

- Whether they remain as separate entities, or

- If they should combine in some manner.

But Wait. There's More. FinWise is Actually a FinTech.

In reality, FinWise is NOT just providing services to commercial and consumers who need banking services through FinWise. Au contraire.

In fact, FinWise has a growing Book of Business providing financial services to businesses who want/need to provide credit to their customers, whether those be other businesses or consumers.

FinWise began this process back in 2011 with its Point-Of-Sale programs.

Today, those efforts have been expanded to include its Buy Now, Pay Later programs.

And as the company continues to develop and perfect its Artificial Intelligence-powered FinView Analytics Platform, FinWise will be able to make better and better decisions based upon the credit-worthiness of individuals and organizations, information that will also prove invaluable to all sorts of entities.

Taken in concert, such capabilities place FinWise squarely in the center of what BofA Securities' Sam Orme and Chris Gammons recently defined as the coming national "Financial Services" hub centered in Utah.

FinWise's Messed-up Valuation Model.

With 12.248 million shares outstanding and a closing price yesterday of $12.90/share, the current market cap for FinWise is roughly $158 million.

Based upon some really rough math based upon known revenue through the first nine months of 2021, I can see FinWise producing around $28.63 million in gross sales for 2021.

Taken in concert ($158MM divided by $28.63MM), I end up with a Politis Multiple of about 5.52, which is right in the ballpark, valuation-wise, for banking institutions today.

But what happens if FinWise were valued like a FinTech instead of as a bank holding company?

Take the extreme example of Bill.com (NYSE:BILL), which earlier this year announced its purchase of Lehi, Utah-based Divvy for $2.5 billion.

As of yesterday's market close, Bill.com's per share price closed at $251.31/share, and the firm had a total of 102.55 million shares outstanding, giving it a market capitalization of $25.77 billion.

With the projected 12-month trailing revenue of Bill.com of $308.46 million, it's fairly easy to come up with a Politis Multiple of 83.55. (That's $25.772 billion divided by $308.46 million.)

So ... what happens if FinWise is valued using a FinTech multiple?

Heck, use a multiple that's roughly 1/10th of the Bill.com multiple at 8.36, and you end up with a theoretical FinWise valuation of close to $240 million.

Conversely, slice the Bill.com multiple in half to 41.77 and apply it to FinWise and all of the sudden FinWise is valued at close to $1.2 billion.

And at a mere 12.248 million shares outstanding today, that would drive the price of FinWise shares to close to $98/share.

Conclusion

For the record, I do not believe that FinWise Bancorp is worth nearly $1.2 billion, not by a long shot, at least not today.

Then again, I also do not think FinWise is fairly valued at $158 million either.

So where should it be valued? Great question. I'll leave that for others to address who are better at crunching financial calculations than I am.

What I can tell you is this:

If FinWise Bancorp is not a FinTech today, then it's right on the cusp of becoming one.

But in my book, it's already there.

NOTE:

The author does not have any holdings or financial interest in FinWise Bancorp.