An FTC letter crowing about the decision to cancel the acquisition shows Sportsman's made the right decision. However, our review suggests the regulators are living in the past.

After a nearly one year gestation period, Sportsman's Warehouse Holdings (NasdaqGS:SPWH) is no longer getting acquired for upwards of $785 million by the parent company of Bass Pro Shops and Cabella's.

As initially reported in this 2 April 2021 report titled "Two Acquisitions Close, Two in Play, and More," shareholders of West Jordan, Utah-based Sportsman's had just approved the acquisition of the company by Great American Outdoors Group by a 28-to-1 margin last March.

The planned merger had been announced originally in mid-December 2020, with an all-cash offer price of $18.00 per share.

Once consumated, Sportsman's would have joined three existing outdoor retailers in the Great American fold:

- Bass Pro Shops,

- Cabella's, and

- White River Marine Group.

Beyond what appeared from the outside to be an unexpectedly long process for the acquisition to close, neither Sportsman's or Great American gave any indications that the merger would not go through.

Until this past weekend that is which is when I stumbled across a 2 December 2021 filing by Sportsman's with the U.S. Securities and Exchange Commission explaining in fairly terse language that the merger had been cancelled.

The reason for the decision was quite clear from Sportsman's Form 8-K filing with the SEC, specifically:

"The decision to terminate the Merger Agreement follows feedback from the Federal Trade Commission (“FTC”) that led the parties to believe that they would not have obtained FTC clearance to consummate the Merger."

The very next day, the U.S. Federal Trade Commission issued a press release through its Bureau of Competition stating that it had conducted an extensive 11-month investigation of the proposed merger and said that the "Transaction would have harmed competition in outdoor specialty retail stores in local markets throughout the United States."

Holly Vedova, director of this Bureau of Competition then went so far as to say in its release,

"I am pleased that Great Outdoors and Sportsman’s Warehouse decided to abandon their proposed merger, which would have harmed consumers through increased prices, reduced product offerings, and diminished quality and service."

Which is all fine and good, had this decision been made before the birth of eCommerce, but it wasn't.

The Knuckleheads at the FTC and eCommerce

I wonder if Holly Vedova and her sidekicks at the Federal Trade Commission have heard of this new fangled thing called eCommerce?

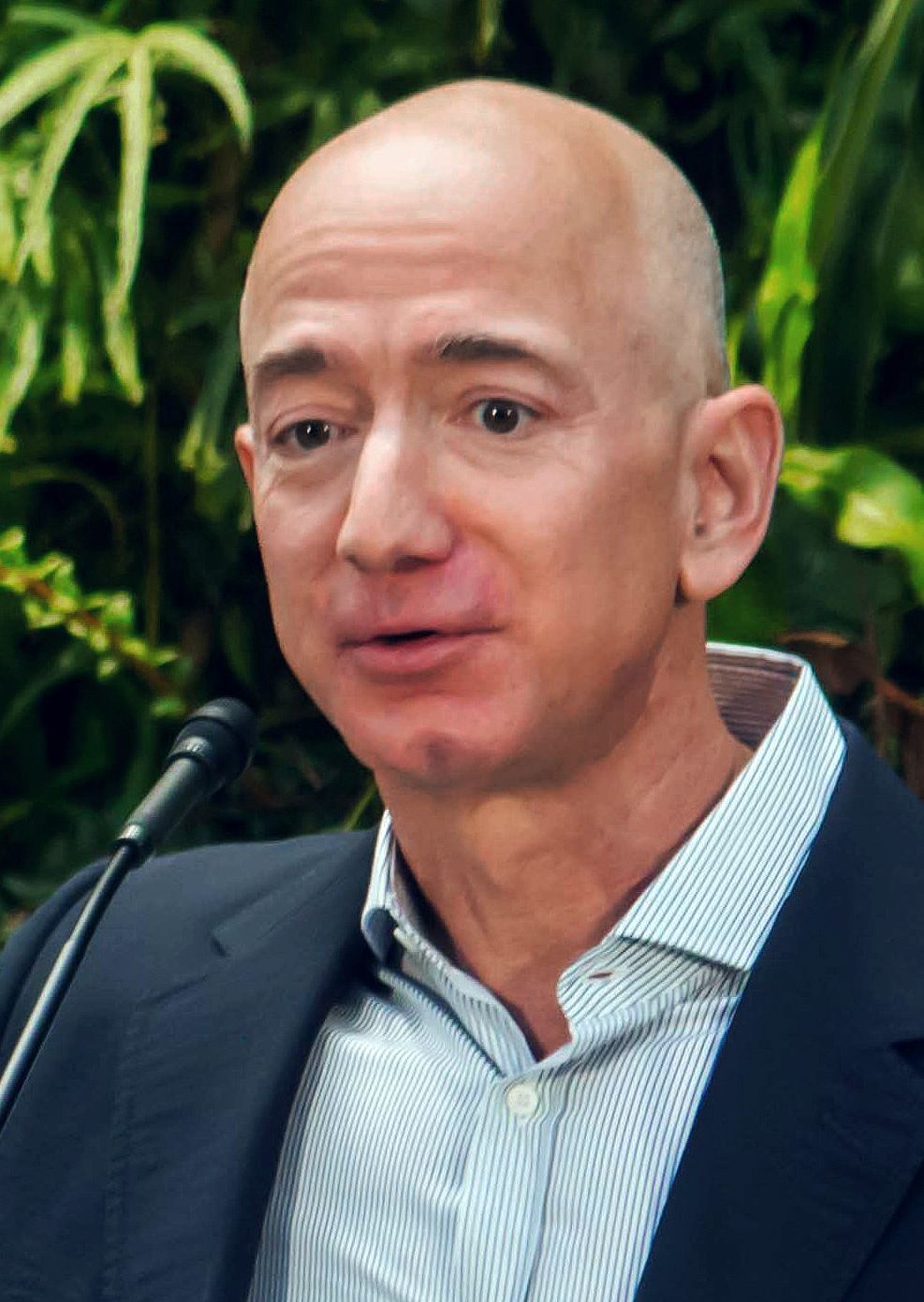

It kind of got its start back in 1994 when this now bald-headed dude name Jeff made it possible to purchase books over the Internet.

Last year Jeff's company, Amazon, sold nearly $470 billion worth of products, and services (of every kind) electronically. Over something now known as the World Wide Web.

In fact, most of those sales actually took place on these nifty, handheld electronic devices called smartphones.

There's over 5 billion of them on the planet today, Holly. Did you know that?

Yep, people use them thar smartphones all the time to do all sorts of things, including buying a ton of stuff, including sporting goods, of all types, like

- Guns and

- Ammunition and

- Fishing poles and

- Sleeping bags and

- Running shoes and

- Rain gear and

- Mosquito netting and

- On and on and on.

Heck, virtually everything you could find in a Sportman's Warehouse or a Bass Pro Shops or a Cabella's you can buy online from Amazon.

And from tons of other electronic-only, online retailers.

But then you can also buy those same sporting goods online from Sportsman's Warehouse and Bass Pro Shops and Cabella's.

Turns out they each have their own online stores. Imagine that.

Interestingly, with just a little poking around on the Internet, I was able to determine that the top 10 sporting goods retailers in the U.S. generated over $105 billion in sales in 2020. Not all of 'em, just the top 10.

And only Bass Pro Shops was on that list at an estimated annual revenue of $6.5 billion.

Which kind of means that the whole idea of Antitrust Law when applied to retail, even when updated in 1976 with passage of the Hart-Scott-Rodino Antitrust Improvement Act, is woefully out-of-date in this eCommerce-enabled world.

But you then again you already knew that, right, Ms. Holly Vedova?!?!

Of course you did.

I'm not sure what kind of problem you have with sporting goods retailers, especially those that cater to individuals who happen to like things like hunting and fishing and camping.

But my guess is that you and your cronies do have a dislike for such activities, and shutting down a dangerous acquistion like the one between Sportsman's Warehouse and Great American Outdoors must have really made you feel good.

Craziness. That's all I've got to say.

The $55 Million Payday Post-Merger-Implosion

About the only good thing that I can see that comes out of this merger-implosion for Utah-based Sportsman's is that Great American has had to pay $55 million to the West Jordan-headquartered company because the deal did NOT go through (regardless of why).

Not that that $55 million payout was beneficial to Great American, but that's a whole 'nother story, right?!?!

But ... as of last Friday's market close, Sportsman's stock price of $10.90/share is within 14% of the share price over a year ago from when the merger was first announced.

In the meantime, there's been an entire year's worth of river pass under the bridge and a ton of brain damage inflicted by the hoop-jumping caused by the bureaucrats at the FTC.

So ... there you have it. A bit late, timing-wise, to bring you (our readers) up to speed on this particular deal.

But now you know.

We just figured it was better late than not at all.

PUBLISHER'S NOTE:

If you've got a news item of note that you think would be interesting to those who track Utah's business community would, please drop us a note at news@siliconslopes.com. Thanks.